Business Valuation

Business Valuation

Exit Planning Tools for Estimating and Understanding the Economic Value of a Business

Your ExitMap Business Valuation Primer

How much is your company worth?

A realistic look at the demographics of potential buyers of Main Street and Mid-Market companies by multiples of SDE( Sellers Discretionary Earnings) and EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization).

This two and a half minute video describes multiples paid for businesses by different buyers, including (click term to expand):

Entrepreneurial Buyers, Industry Buyers, Professional Investors, Strategic Buyers and those in The Neutral Zone

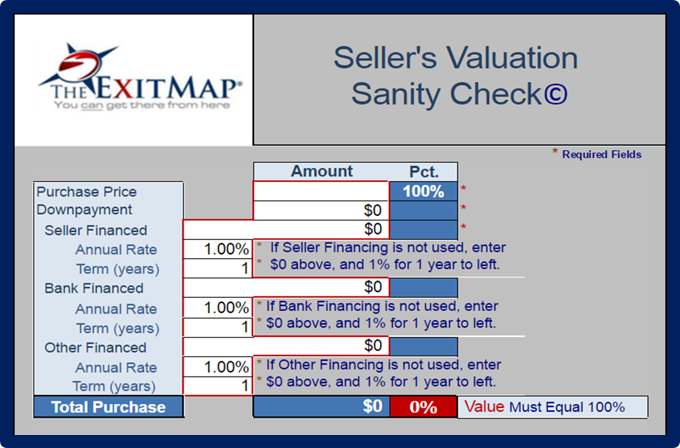

Test your Assumptions with The Seller’s Valuation Sanity Check

This tool examines your proposed value in light of the ability to pay an acquisition loan, a salary to the new owner, and provide a return on investment for the buyer’s cash down payment.

The parameters we use are those commonly expected by third party lenders, including most SBA lenders. They will create a salary expense whether the buyer expects to be paid or not.

Plug in your own numbers and see how the price holds up. Just click the image and check it out.

Of all the misconceptions by business owners, the ones surrounding their company’s value are both the most common and often wildly inaccurate.

Of all the misconceptions by business owners, the ones surrounding their company’s value are both the most common and often wildly inaccurate.

About 90% of small business sales are asset transactions. Only about 10% close as a transfer of stock ownership. That will double the tax estimate from 20% capital gains to a 40% ordinary income rate. Businesses transfer debt-free. So if an owner owes anything on his credit line, that comes off the top from the proceeds, but the tax is also still payable and also comes off the top. The problem is exacerbated when a planner, not taking this into consideration, assumes that the owner has and knows the net value of his business.

If you are like 85% of all owners and plan to sell your business to a third party, the first thing to do is Engage a Valuation Professional. The second thing is to Take that Valuation to Your Accountant for tax modeling. Start your exit planning by embracing reality. You’ll be a lot happier in the long run.

Valuation of a small business is a combination of art and science. No two small companies are alike. A multiple of profits or cash flow is only the starting point and beauty lies in the eyes of the beholder.

Valuation of a small business is a combination of art and science. No two small companies are alike. A multiple of profits or cash flow is only the starting point and beauty lies in the eyes of the beholder.

The multiples paid for businesses depend on the type of buyers they attract. Commonly, those that sell for less than $2,000,000 are considered “Main Street.” Their target buyers are individuals who are purchasing an income. They intend to work in the business, and to earn a regular paycheck by running it. Main Street pricing is typically between 2.1 and 2.8 times SDE and based on simple arithmetic. The closer you come to 3 times SDE, the less a buyer is able to pay both the bank and himself.

For larger companies, those that attract financial and industry acquirers, the multiples are higher, but the multiplier is lower. Those buyers anticipate paying for professional management, so the owner’s compensation is less of a consideration. They look at EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) to calculate available cash after all the expenses of running the business are paid.

These numbers are based on actual sales data and industry surveys. Sellers often confuse the terms revenue and income, or apply EBITDA multiples to SDE. They are greatly disappointed and angry when legitimate offers fall far below their expectations. Just because your planner or your banker didn’t challenge your valuation estimate doesn’t make it fact.

Engage a Valuation Professional to ensure you really know the value of your business and then Take the Valuation to Your Accountant for tax modeling.

The ExitMap® Assessment for Business Owners

The First Step to Understanding the Complexities of Preparing a Company for Transition

The ExitMap® Assessment questionnaire consists of 22 questions and produces a high quality 12-page summary report which will be emailed to you. The report ranks the overall preparedness of a company for transition and provides a breakdown of the four major categories of readiness; Finance, Planning, Profit/Revenue and Operations. If you are a business owner just starting to think about exit planning or if you just want to know where you and your company stand, this is your first step.