Your ExitMap Directory of Essential Tools

Your ExitMap Directory of Essential Tools

Exit Planning Tools from the book, Your Exit Map: Navigating the Boomer Bust by John F. Dini

We provide demonstration versions of our tools so business owners can test their own assumptions.

Fully functional and printable tools are available from your local ExitMap Affiliate.

Your ExitMap Self-Assessment Tools:

An Array of Interactive Resources that Assess Value and Demonstrate Your Exit Readiness

| Your ExitMap Tools | Description and Access |

The ExitMap Assessment |

A free exit planning tool that ranks the overall preparedness of your company for transition and provides a breakdown of the four major categories of your exit readiness: Finance, Planning, Profit/Revenue, and Operations. The Assessment consists of 22 questions, takes only 15 minutes to complete, and requests no confidential financial information. It produces a 12-page summary report that will be emailed to you.

Navigation Bar: Tools from the Book | ExitMap Assessment If you’re working with a trusted Advisor, be sure to include his/her information in the Advisor fields. |

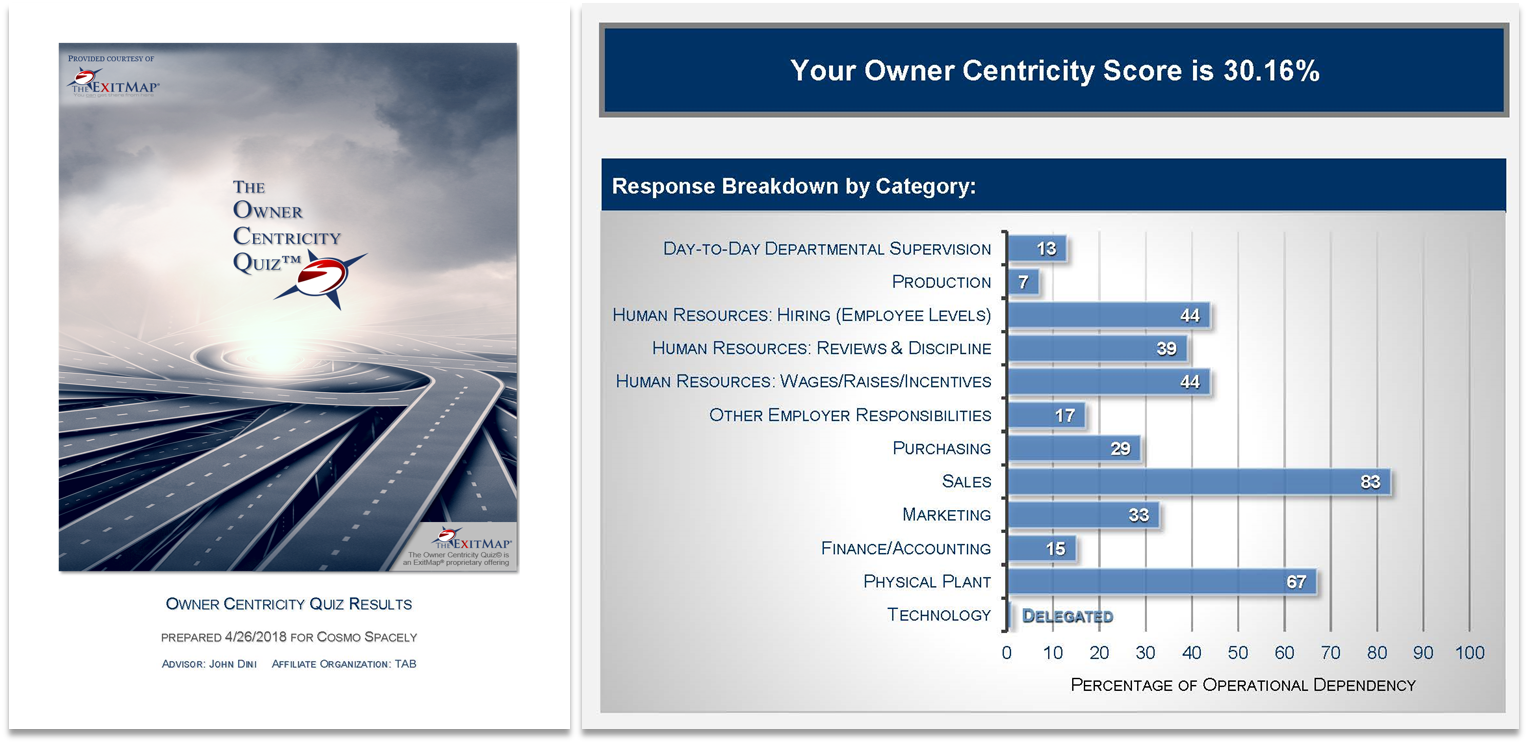

The Owner Centricity Quiz |

Whether you are planning your eventual exit from the business or seeking greater operational efficiencies, the OCQ provides a valuable overview of the areas and functions most dependent on you. It generates an 8-page overview which will be emailed to you. Use it to help prioritize delegation responsibilities, identify areas where management may be underperforming, or plan your next key hire.

Navigation Bar: Tools from the Book | Owner Centricity Quiz If you’re working with a trusted Advisor, be sure to include his/her information in the Advisor fields. |

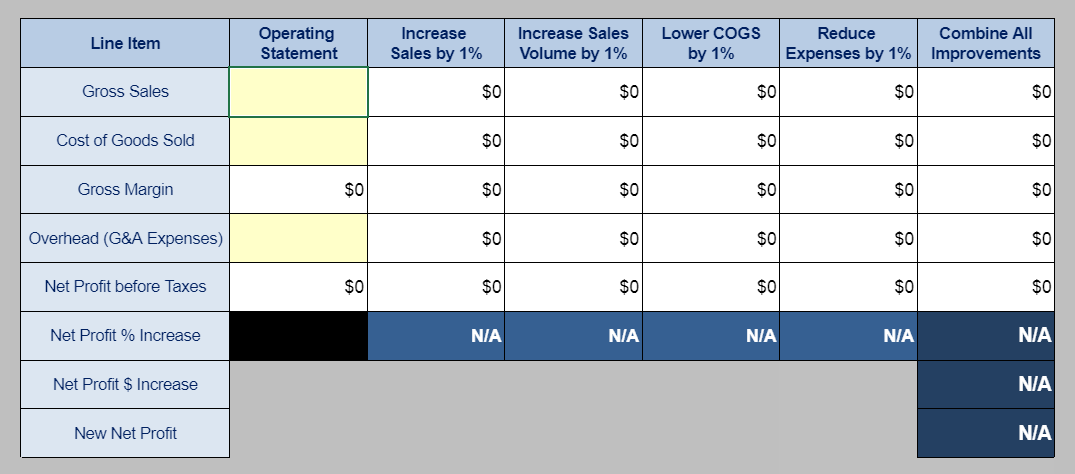

The Power of One |

Your financial goals may need to be covered by the sale of your company if you cannot reach your retirement objective in your chosen timeframe. A change of one percent in the typical lines of financial statements can yield a significant improvement in your bottom line profits. Use this worksheet to see the effect a 1% change will make on Selling Price, Sales Volume, Cost of Goods Sold, and Expenses.

Navigation Bar: Tools from the Book | Projecting Cash Flow Use this tool with a trusted advisor to see the effect a change of 1% can have on business value. |

SDE Calculator |

The SDE Calculator determines how much the owner benefits provided by your company will be worth it when it comes time to sell. The value of any business is determined by the income it provides its owners. Seller’s Discretionary Earnings (SDE) is used to assign a valuation base to the full benefit stream that a business provides to an owner.

Navigation Bar: Tools from the Book | Seller’s Discretionary Earnings Use this tool with a trusted advisor who can help identify the owner benefits that affect value. |

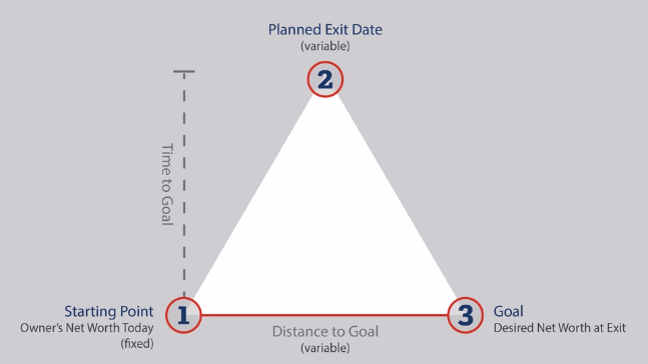

Triangulation Worksheet |

The Triangulation Tool uses your ideal timeframe to determine what it will take for you to retire with the amount of money you need by plotting three points of critical information: Where you are now, where you need to go and how much time you’re willing to take to get there. Your Distance to Goal will need to be covered by the sale of your company if you cannot reach your objective in your chosen timeframe.

Navigation Bar: Tools from the Book | Triangulating Your Goals Use this tool with a trusted advisor who can help align with your goals with your timeframe. |

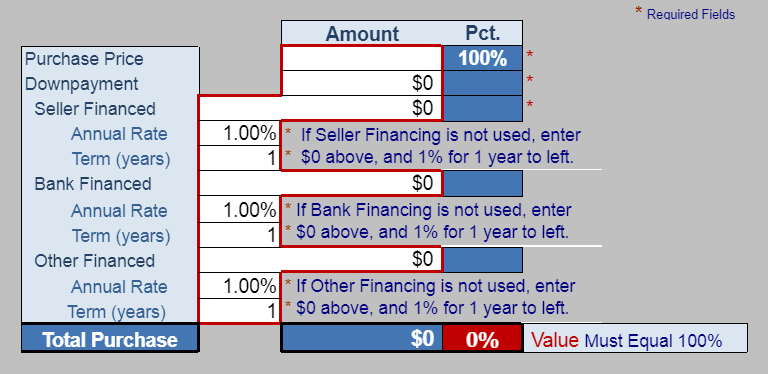

Seller’s Sanity Check |

Every transaction is made possible by the cash flow of the company. The Seller’s Valuation Sanity Check examines your proposed value in light of its ability to pay an acquisition loan, a salary to the new owner, and provide a return on investment for the buyer’s cash down payment. The parameters we use are those commonly expected by third-party lenders, including most SBA lenders.

Navigation Bar: Tools from the Book | Seller’s Sanity Check We recommend using the Sanity Check with a trusted advisor who will consider each line item. |

Due Diligence Checklist |

Due diligence is the process that a potential buyer uses to evaluate a target company and its assets for an acquisition. By planning due diligence activities carefully, a business owner can be better prepared to successfully complete the sale or transfer of the company. This list represents activities and issues that apply to both sides of the transaction.

Navigation Bar: Tools from the Book | Due Diligence Checklist We recommend using the checklist with a trusted advisor who will consider each line item. |

Management Succession Worksheet |

A critical part of any business transition is anticipating the planned transfer of an owner’s management and operational duties. You may already have trained successors in place who can seamlessly take over but unless you have been actively delegating responsibilities, you will need a well-defined plan. Use this worksheet to identify managers and employees who can effectively perform your management duties.

Navigation Bar: Tools from the Book | Management Succession We recommend using the worksheet with a trusted advisor to help identify successors. |

Personal Vision Worksheet |

Defining your Personal Vision (PV) is one of the most important things you can do for yourself and your business. It is a 5 to 10-year plan that identifies what you want your business to do for you. As an owner, you run a company for your own benefit. You assume the risks, and put in the effort, with an expectation of results. Clearly defining that objective helps keep your focus and balance.

Navigation Bar: Tools from the Book | Your Personal Vision We recommend using this worksheet with a trusted advisor to help you identify your goals. |

The ExitMap® Assessment©

The First Step to Understanding the Complexities of Preparing a Company for Transition

The ExitMap® Assessment questionnaire consists of 22 questions. It produces a high-quality 12-page summary report which is emailed to you. The report ranks the overall preparedness of a company for transition and provides a breakdown of the four major categories of readiness; Finance, Planning, Profit/Revenue, and Operations. If you are just starting to think about exit planning or if you just want to know where you and your company stand, this is your first step.