Exit Options: Third Party Sales

Exit Options: Third Party Sales

Exit Planning Tools and Strategies for Selling your Business to a Third Party

Third Party Sales

If you don’t have suitable successors among your family or employees, you may decide to sell your business to a third party. In order to maximize your selling price, you must develop a step-by-step plan that increases the value of your business so that it is as attractive as possible to prospective buyers.

If you don’t have suitable successors among your family or employees, you may decide to sell your business to a third party. In order to maximize your selling price, you must develop a step-by-step plan that increases the value of your business so that it is as attractive as possible to prospective buyers.

If you are selling a Main Street business (under $2,000,000 sale price) you seriously need to understand the market. We are entering the most challenging period for business sales in history. Over the next 20 years, expect 150,000 owner retirements per year. Intermediaries (brokers, private equity and M&A) account for only about 9,000 transactions a year. That leaves a lot of folks looking for a way to cash out.

If you are considering selling to a third party, you need to understand today’s buyers to ensure that your company is competitive in today’s market.

If you are considering selling to a third party, you need to understand today’s buyers to ensure that your company is competitive in today’s market. Selling to a third party requires that you have your internal house in order. There are many variables that can derail a lucrative sale, including:

Selling to a third party requires that you have your internal house in order. There are many variables that can derail a lucrative sale, including:

• Stay-behind agreements for key personnel

• Governance and voting snags

• Minority shareholder rights

• Structural tax traps

• Depreciation recovery

• Build In Gains (BIG) taxes

• Vendor and customer approval rights

• Inventory valuation issues

Types of Buyers

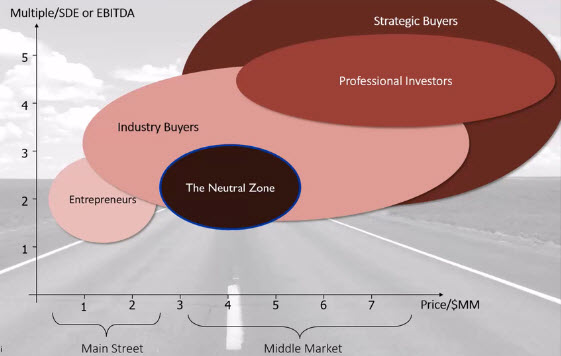

Watch a short video on the types of buyers that might be interested in purchasing your business. This two and a half minute video describes multiples that are paid for businesses by each of the different types buyers.

Watch a short video on the types of buyers that might be interested in purchasing your business. This two and a half minute video describes multiples that are paid for businesses by each of the different types buyers.

It provides a realistic look at the demographics of potential buyers of Main Street and Mid-Market companies by multiples of SDE( Sellers Discretionary Earnings) and EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization).

Click here to view the video.(You will be redirected to the Valuation page.)

The tsunami of Baby Boomer retirements we will reach a peak of nearly 500 unsold businesses a day within the next 5 years. The statistics are immutable. That means you will inevitability be competing to sell your business in a buyer’s market.

The tsunami of Baby Boomer retirements we will reach a peak of nearly 500 unsold businesses a day within the next 5 years. The statistics are immutable. That means you will inevitability be competing to sell your business in a buyer’s market.

When considering an exit from your business, you have only five choices.

The first is to simply ignore it and hope for the best. For any owner who holds most of his or her net worth in the company, that’s not a great option.

The second is to watch, and wait for an opening. That requires following small business sales for favorable trends, and a flexible retirement plan that can take advantage of market conditions or an unexpected opportunity.

The third is a planned liquidation. If you can achieve your financial goals by running the business a while longer, and you choose not to invest in building a company that runs without you, this is a viable strategy, albeit without the satisfaction of a large final payday.

The third is a planned liquidation. If you can achieve your financial goals by running the business a while longer, and you choose not to invest in building a company that runs without you, this is a viable strategy, albeit without the satisfaction of a large final payday.

The fourth is to build your own internal exit plan, and execute it without many of the unknowns involved when taking your business to the market. It requires choosing an insider (family or employee) who understands the business, and is happy to have the opportunity to own it.

The fifth is to build a business suitable for sale in a highly competitive environment. To sell to a third party, such a company must have strong systems, dependable revenues, accomplished management (not including you), and profitability greater than most other companies a buyer might consider, whether those are in your industry or not.

The bottom line is that with each passing day, another 500 businesses go on the market. You need to take the time to put together a plan that builds value if your company even has a chance of being attractive to the next generation of buyers. Want to know where you and your company stand? Take a Free Assessment.

The ExitMap® Assessment for Business Owners

The First Step to Understanding the Complexities of Preparing a Company for Transition

The ExitMap® Assessment questionnaire consists of 22 questions and produces a high quality 12-page summary report which will be emailed to you. The report ranks the overall preparedness of a company for transition and provides a breakdown of the four major categories of readiness; Finance, Planning, Profit/Revenue and Operations. If you are a business owner just starting to think about exit planning or if you just want to know where you and your company stand, this is your first step.