Your ExitMap Blog

Your ExitMap Blog

Exit Planning Articles Focused on Improving Value

Build: Improving Value

Enhancing the value of your business takes on new importance when you are looking at cashing out. How do you secure employees and customers? How do systems and processes affect your sale price? What specific areas of improvement will make your business more attractive?

Enhancing the value of your business takes on new importance when you are looking at cashing out. How do you secure employees and customers? How do systems and processes affect your sale price? What specific areas of improvement will make your business more attractive?

Most Recent Your ExitMap Blog Articles

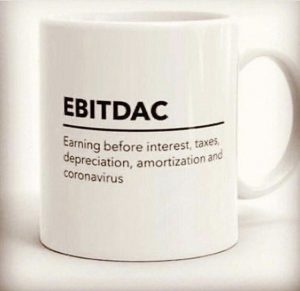

What is a Certified Business Valuation and When Do I Need One? A Certified Business Valuation is a comprehensive assessment conducted by a qualified professional to determine the fair market value of a business. It involves a systematic analysis of various factors such as financial statements, industry trends, market conditions, company assets, intellectual property, customer base, and other relevant aspects to estimate the worth of a business. You may need a Certified Business Valuation in several situations, including: Selling or Buying a Business: When you’re involved in a business sale or acquisition, a valuation helps determine a fair asking price or offer, ensuring both parties understand the business’s value. Obtaining Financing: When seeking a loan or financing ... Read more A Certified Business Valuation is a comprehensive assessment conducted by a qualified professional to determine the fair market value of a business. It involves a systematic analysis of various factors such as financial statements, industry trends, market conditions, company assets, intellectual property, customer base, and other relevant aspects to estimate the worth of a business. You may need a Certified Business Valuation in several situations, including: Selling or Buying a Business: When you’re involved in a business sale or acquisition, a valuation helps determine a fair asking price or offer, ensuring both parties understand the business’s value. Obtaining Financing: When seeking a loan or financing ... Read more Impressions of Value in Exit Planning Business owners, advisors, and buyers frequently have widely different impressions of value when it comes to a business. The Pepperdine Private Capital Markets Survey canvasses intermediaries who sell privately held Main Street and mid-market companies. One question is about the obstacles that prevented the sale of a business. The number one response is “Owners’ unreasonable expectations of value.” That may be self-serving or an excuse. Nonetheless, valuation is a sensitive subject. Many owners have worked in the business for 30 or 40 years. They assume it will fund their next 20 years of retirement. Their target price is set only by their desired lifestyle after ... Read more Business owners, advisors, and buyers frequently have widely different impressions of value when it comes to a business. The Pepperdine Private Capital Markets Survey canvasses intermediaries who sell privately held Main Street and mid-market companies. One question is about the obstacles that prevented the sale of a business. The number one response is “Owners’ unreasonable expectations of value.” That may be self-serving or an excuse. Nonetheless, valuation is a sensitive subject. Many owners have worked in the business for 30 or 40 years. They assume it will fund their next 20 years of retirement. Their target price is set only by their desired lifestyle after ... Read more "Work From Anywhere" Comes Full Circle Work from anywhere has been a necessity, an epithet, an obstacle, and an opportunity over the last 3 years. To paraphrase Aristotle’s axiom about Nature (“Horror Vacui”), business abhors a vacuum. Where one occurs, it is quickly filled. Work from anywhere started as a COVID-induced necessity. During the lockdowns of 2020-2021 (and longer in some places) we all had a crash course in video calling, VPNs, and virtual meetings. Employees quickly expanded the definition of anywhere. They tired of shunting the children off to a bedroom during conference calls, or using office-like backdrops to hide their kitchen cabinets. Soon they began changing their backgrounds to ... Read more Work from anywhere has been a necessity, an epithet, an obstacle, and an opportunity over the last 3 years. To paraphrase Aristotle’s axiom about Nature (“Horror Vacui”), business abhors a vacuum. Where one occurs, it is quickly filled. Work from anywhere started as a COVID-induced necessity. During the lockdowns of 2020-2021 (and longer in some places) we all had a crash course in video calling, VPNs, and virtual meetings. Employees quickly expanded the definition of anywhere. They tired of shunting the children off to a bedroom during conference calls, or using office-like backdrops to hide their kitchen cabinets. Soon they began changing their backgrounds to ... Read more Contingency and Continuity Planning When business consultants talk about preparing for unforeseen problems, they frequently commingle the terms contingency and continuity. The terms are not synonymous, and there are important differences between them. Contingency Planning Contingency planning is generally accepted to mean how a business will respond in the event of a disaster. This could entail a building fire, severe weather, a strike of key service workers, civil unrest, or riots (depending on the audience.) Additionally, in the age of cybersecurity, ransomware or a denial of service attack, identity theft, and electronic fraud are all well qualified to be categorized as disasters. Generally speaking, these are all insurable events. ... Read more When business consultants talk about preparing for unforeseen problems, they frequently commingle the terms contingency and continuity. The terms are not synonymous, and there are important differences between them. Contingency Planning Contingency planning is generally accepted to mean how a business will respond in the event of a disaster. This could entail a building fire, severe weather, a strike of key service workers, civil unrest, or riots (depending on the audience.) Additionally, in the age of cybersecurity, ransomware or a denial of service attack, identity theft, and electronic fraud are all well qualified to be categorized as disasters. Generally speaking, these are all insurable events. ... Read more Key Employees: Build and Protect Business Value Key Employees You may have people working in key roles who are instrumental in growing and building the value of your business. These key people can be identified as having the following characteristics: Makes a substantial business contribution Possesses critical information or knowledge Maintains and nourishes key contacts and relationships Sellable Business In helping clients plan to build a sellable business, and then eventually exit on their terms and conditions, we emphasize that “key people are a key value driver” in realizing success in both of those strategic goals. And, we find it helpful for owners to have two categories in mind when considering key ... Read more Key Employees You may have people working in key roles who are instrumental in growing and building the value of your business. These key people can be identified as having the following characteristics: Makes a substantial business contribution Possesses critical information or knowledge Maintains and nourishes key contacts and relationships Sellable Business In helping clients plan to build a sellable business, and then eventually exit on their terms and conditions, we emphasize that “key people are a key value driver” in realizing success in both of those strategic goals. And, we find it helpful for owners to have two categories in mind when considering key ... Read more Non-Qualified Plans When I talk to business owners about “non-qualified plans,” their first reaction is often “Hold on there. I don’t want to get in trouble!” The term “Non-qualified” merely refers to the Employee Retirement Income Security Act of 1974, more commonly known as ERISA. As the title indicates, it is the basic set of regulations for retirement plans. If your company offers a 401K or SEP IRA, it has a Qualified Plan. If you have an Employee Stock Ownership Plan (ESOP), that is also an ERISA plan. Under the terms of ERISA, a plan must be made available to all employees. In return, the company can ... Read more When I talk to business owners about “non-qualified plans,” their first reaction is often “Hold on there. I don’t want to get in trouble!” The term “Non-qualified” merely refers to the Employee Retirement Income Security Act of 1974, more commonly known as ERISA. As the title indicates, it is the basic set of regulations for retirement plans. If your company offers a 401K or SEP IRA, it has a Qualified Plan. If you have an Employee Stock Ownership Plan (ESOP), that is also an ERISA plan. Under the terms of ERISA, a plan must be made available to all employees. In return, the company can ... Read more Internal Leaders Affect the Value of Your Business Internal leaders may not be obvious. They may not even have a “leadership” title. Make no mistake, however; internal leaders are critical to value and attractiveness when it comes to selling your business. In Super Bowl 55 we saw the impact of an internal leader. Tom Brady has the highest winning percentage of any single athlete in major professional sports. The Tampa Bay Buccaneers have (or at least did up until this season,) the worst win/loss record over their entire existence of any major professional sports team. Yet one man changed the culture of the organization almost overnight. Remember, for all the accolades being heaped ... Read more Internal leaders may not be obvious. They may not even have a “leadership” title. Make no mistake, however; internal leaders are critical to value and attractiveness when it comes to selling your business. In Super Bowl 55 we saw the impact of an internal leader. Tom Brady has the highest winning percentage of any single athlete in major professional sports. The Tampa Bay Buccaneers have (or at least did up until this season,) the worst win/loss record over their entire existence of any major professional sports team. Yet one man changed the culture of the organization almost overnight. Remember, for all the accolades being heaped ... Read more Exit Planning and Marathon Runners “Eat well and exercise!” Just about everyone over 30 has heard this advice from someone interested in our health, usually a doctor. We all know that we should begin by doing SOMETHING, yet we wind up not really doing anything. We know deep inside that if we want to live long and prosper, taking a few painful steps will have long-term pay-offs, but all too often those first few steps never happen. What has this got to do with Exit planning? Business owners know they should be taking steps to plan for the future, but all too often they don’t seem to get around to ... Read more “Eat well and exercise!” Just about everyone over 30 has heard this advice from someone interested in our health, usually a doctor. We all know that we should begin by doing SOMETHING, yet we wind up not really doing anything. We know deep inside that if we want to live long and prosper, taking a few painful steps will have long-term pay-offs, but all too often those first few steps never happen. What has this got to do with Exit planning? Business owners know they should be taking steps to plan for the future, but all too often they don’t seem to get around to ... Read more Wealth Management for Business Owners Wealth Management Considerations for Business Owners Small business owners are at times neglected by the wealth management community as the business is commonly (not always) the owner’s largest asset rather than a portfolio of stocks, bonds, and mutual funds. You’d be well-advised as a business owner to engage a Financial Advisor who is proactive and experienced in factoring your future plans for the business, into your overall plan for managing your wealth. Key Elements of Exit Planning Impactful wealth management for you as a business owner would include at least these elements of exit planning: Clarifying what “exit” means to you. For example, do ... Read more Wealth Management Considerations for Business Owners Small business owners are at times neglected by the wealth management community as the business is commonly (not always) the owner’s largest asset rather than a portfolio of stocks, bonds, and mutual funds. You’d be well-advised as a business owner to engage a Financial Advisor who is proactive and experienced in factoring your future plans for the business, into your overall plan for managing your wealth. Key Elements of Exit Planning Impactful wealth management for you as a business owner would include at least these elements of exit planning: Clarifying what “exit” means to you. For example, do ... Read more The Dismal Ds and Exit Planning The “Dismal Ds” is an inside joke in exit planning. Every industry and profession has them. In some, it’s “You can have it done well, done fast, or done cheaply. Pick any two.” In planning it’s “Sooner or later, every owner exits his or her business… 100% guaranteed.” Clearly, that refers to the unplanned but inevitable departure from the biggest D – Death. That isn’t the only D, however. There are others, NONE of which lead to a controlled, lucrative, or enjoyable transition. Most start with dis- defined as “dis– 1. a Latin prefix meaning “apart,” “asunder,” “away,” “utterly,” or having a privative, negative, or reversing force.” ... Read more The “Dismal Ds” is an inside joke in exit planning. Every industry and profession has them. In some, it’s “You can have it done well, done fast, or done cheaply. Pick any two.” In planning it’s “Sooner or later, every owner exits his or her business… 100% guaranteed.” Clearly, that refers to the unplanned but inevitable departure from the biggest D – Death. That isn’t the only D, however. There are others, NONE of which lead to a controlled, lucrative, or enjoyable transition. Most start with dis- defined as “dis– 1. a Latin prefix meaning “apart,” “asunder,” “away,” “utterly,” or having a privative, negative, or reversing force.” ... Read more An Often Neglected Means Of Protecting Business Value Protect The Business Most Valuable Asset A compelling and common characteristic of successful business owners is optimism. The “glass is always half full” attitude results in the risk-taking, perseverance, and innovation it takes to build, grow, and protect a successful business. Like any personal strength, this optimism can quickly become a weakness when there is a need to plan for the gloomy business contingencies of death and disability. What happens to the business due to either of these less than optimistic events is the last thing an optimistic owner wants to think about. Some might say that perhaps owners don’t care if the business fails ... Read more Protect The Business Most Valuable Asset A compelling and common characteristic of successful business owners is optimism. The “glass is always half full” attitude results in the risk-taking, perseverance, and innovation it takes to build, grow, and protect a successful business. Like any personal strength, this optimism can quickly become a weakness when there is a need to plan for the gloomy business contingencies of death and disability. What happens to the business due to either of these less than optimistic events is the last thing an optimistic owner wants to think about. Some might say that perhaps owners don’t care if the business fails ... Read more EBITDAC : What is Your Business Worth Now? Several friends have sent me a picture of an EBITDAC coffee mug this week. As it states, EBITDAC stands for Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus. Will this be the new measure of cash flow for valuing your business? A bleak joke, but one that is on the minds of many business owners, especially Baby Boomers in their late 50s and 60s. Many were postponing their exit planning because business has been so good. As one client told me, “In March we had the best year in the history of my company. It looks like April might be the worst.” Downturns aren’t new, ... Read more Several friends have sent me a picture of an EBITDAC coffee mug this week. As it states, EBITDAC stands for Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus. Will this be the new measure of cash flow for valuing your business? A bleak joke, but one that is on the minds of many business owners, especially Baby Boomers in their late 50s and 60s. Many were postponing their exit planning because business has been so good. As one client told me, “In March we had the best year in the history of my company. It looks like April might be the worst.” Downturns aren’t new, ... Read more Manage Activities; Lead for Results A few weeks ago I posted a comment in the Business Journals Leadership Trust Forum about a life lesson I learned. The difference between effort and outcomes – Manage Activities; Lead for Results. They reached out and asked if I could expand my comments a bit. Those of you who know me won’t find it surprising that it grew into an article. You can find it here. I hope you enjoy it. Remember, lead for results. Invest 15 Minutes and take our FREE Exit Readiness Assessment. We do not request any confidential information. John F. Dini develops transition and succession strategies that allow business ... Read more A few weeks ago I posted a comment in the Business Journals Leadership Trust Forum about a life lesson I learned. The difference between effort and outcomes – Manage Activities; Lead for Results. They reached out and asked if I could expand my comments a bit. Those of you who know me won’t find it surprising that it grew into an article. You can find it here. I hope you enjoy it. Remember, lead for results. Invest 15 Minutes and take our FREE Exit Readiness Assessment. We do not request any confidential information. John F. Dini develops transition and succession strategies that allow business ... Read more Is Google Making Us Stoopid? As an Exit Planner, most of my engagements involve assessing a management team. They may be the intended buyers of the company, or else they are key factors in the saleability of the business. The biggest and most frequent complaint I hear about managers is that they don’t know how to THINK. Business owners lament the inability of employees to discern critical paths, assess alternatives, or analyze complex problems. Examples of Thinking Shortfalls A CPA is doing a final review of a client’s tax returns, as prepared by an associate. As with many business owners, the client has two related entities, one acting as the ... Read more As an Exit Planner, most of my engagements involve assessing a management team. They may be the intended buyers of the company, or else they are key factors in the saleability of the business. The biggest and most frequent complaint I hear about managers is that they don’t know how to THINK. Business owners lament the inability of employees to discern critical paths, assess alternatives, or analyze complex problems. Examples of Thinking Shortfalls A CPA is doing a final review of a client’s tax returns, as prepared by an associate. As with many business owners, the client has two related entities, one acting as the ... Read more Exit Planning: Controlling Your Choices Many owners are reluctant to plan for their departure from the business. In some cases it’s because they are too comfortable with ambiguity (see my previous post.) For others it is because they fear losing control. They believe that setting a final date for their departure, even tentatively, starts a process that will take on a life of its own. The tag line of this column is “Control the most important financial event of your life.” Control is the key. Refusing to deal with the realities of an eventual transition from the business is surrendering control. Sooner or later, something will happen that requires a transfer of the ... Read more Many owners are reluctant to plan for their departure from the business. In some cases it’s because they are too comfortable with ambiguity (see my previous post.) For others it is because they fear losing control. They believe that setting a final date for their departure, even tentatively, starts a process that will take on a life of its own. The tag line of this column is “Control the most important financial event of your life.” Control is the key. Refusing to deal with the realities of an eventual transition from the business is surrendering control. Sooner or later, something will happen that requires a transfer of the ... Read more |