What is a “Family Business?” A large percentage of small companies have some family involved. For most, it is simple a case of providing employment to family members. If the founder of the company is also the principle revenue generator, it may be a spouse (most often the wife) who keeps the books and runs the office.

Employment of children who can’t (or won’t) find another job is common, and more so in the current economy. In most instances it is just a matter of income transfer with some value attached. The owner could keep handing over money for the child’s living expenses, but he or she wants the offspring to “earn” that money. The business becomes a vehicle for parenting; teaching life lessons about responsibility. In fewer cases, it is a recruiting tool. The owner tries to get the child interested and involved in the business, with hopes that they will seize the opportunity to become part of a succession strategy.

There are scores of variants, such as the absentee family employee who is really just a charity case. Performing no duties, and frequently not even in the same geography of the business, employment is simply a mechanism for the owner to make tax-deductible contributions for someone’s support.

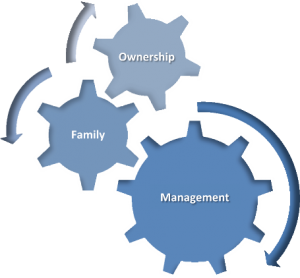

The three circles of this title refer to when the engagement of multiple family members in the business involves a blood (or marriage) relationship, participation in management  decisions, and ownership. For our purposes, all three must be present in order for it to be a “Family Business.”

decisions, and ownership. For our purposes, all three must be present in order for it to be a “Family Business.”

When all three factors are present, they set up a structural conflict that is challenging to deal with. Issac Newton postulated laws governing mass and attraction; the effect one body has on another in relation to its size. The problem with Newton’s laws is that they apply to two, and only two, bodies acting on each other. When there are three bodies of mass the laws become chaotic, since each change in one body not only alters its effect on the others, but immediately alters their effect on each other.

So it is with the laws governing family business relationships. When there are only two roles, effects are fairly predictable. One role, of course, is always the kinship between the parties. If only one of the family members has ownership, the roles in the workplace are pretty plain. If other family members have ownership, but don’t work in the company, their input can be anticipated and occurs within defined parameters. When family members hold two roles in the business, both employee/manager and ownership, each action in one area causes unequal and unpredictable reactions in the others.

In one business, a brother and sister were sold ownership, but until the parents were paid, the siblings remained dependent on their paychecks for normal living expenses. The brother worked long hours, kept a careful eye on expenses, and ran a “tight ship” when it came to employee issues. The sister came in late, left early, and was fond of showing employer largess by issuing unplanned raises to favorite workers. Her sibling and ownership relationships made it difficult to deal with her radically different management style. She felt that she had an equal “right” to run the company as she wished, even if it was the polar opposite of her brother’s style.

In this case, the brother’s solution was to force his sister to sell her stock, and continue to give her a salary conditioned on her no longer coming to the office. The company is better off, but they don’t speak to each other any more.

In another, a brother’s division of the family business underperformed those of his siblings. Eventually he left to work in another company, although he retains his ownership and they still get together for holidays.

The pressure of decision-making and implementation in a family business adds complexity to every situation. Is Dad overriding our opinions because of his greater experience and wisdom, or is it because he regards any dissent from his children as disrespect? Is Mom against the new initiative because she really judges the market to be weak, or is it just her natural inclination to protect what we already have? Has my brother really studied that opportunity, or is he just trying to do something on his own, without his big brother’s shadow over it?

Family members know each other too well to ever make a completely unbiased analysis. The best you can do is recognize the three circles that influence every action, and discuss the mass and attraction of each one when making decisions.

Ouch, I am living this situation. Vision and leadership is the challenging issue. There is not one right way to run company. I learned from you that each business reflects business owner’s personal values and style. Great article and if others respond too, hopefully you will share more on this topic and transitioning family business.

Additional Information,

Actually the most stable relationship system is a three party system where the third party acts as a calming, reasonable voice that facilitates constructive communication and decision making. In family business succession work we have long advocated a three system view: Family, Business and Board. In the latter we work toward a balance of participants between family representatives and respected, independent outsiders with experience and expertise relevant to the current and future work of the business. We typically do not recommend professionals – lawyers, accountants, consultants… who are aligned and indebted financially to the business. The challenge is to start this process long before succession – through family education and involvement of key family members in learning about and appreciating the complexities of running and growing a successful family business. The earlier the better…

Bill Seelig,

bill@seeligs.com

Bill Seelig

Legal succession planning is also important for family businesses. This is especially true when one beneficiary of the owner’s estate is clearly the right person to take over operations and another beneficiary is clearly not interested.