Your ExitMap Blog

Your ExitMap Blog

Exit Planning Articles Focused on your Exit Options

Exit: Exit Options

Should you be targeting a specific segment of the buyer market? How can that be accomplished? What technical issues will you face with taxation, negotiation and contract structure? The specific and unique challenges of Family, Employee and Third-Party sales.

Should you be targeting a specific segment of the buyer market? How can that be accomplished? What technical issues will you face with taxation, negotiation and contract structure? The specific and unique challenges of Family, Employee and Third-Party sales.

Most Recent Your ExitMap Blog Articles

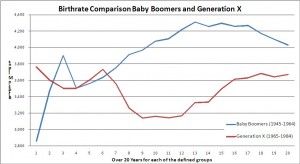

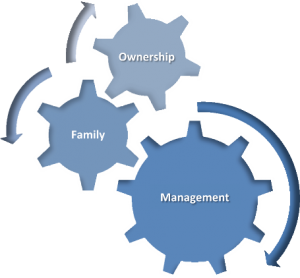

Too Busy to Do Business Another tax filing season has passed, and the entire US accounting profession comes up for air. Of course, thousands of businesses and individuals have filed for extensions, thereby postponing the pain of calculating their final numbers for anywhere from a few days to six months. As the CPAs emerge from their winter burrows and blink in the sun, the rest of the business community reenergizes, suddenly able to move forward with planning and analysis that has been languishing while their numbers-crunchers were busy losing sleep and feasting on ramen noodles. I met with one firm about doing some valuation work in late February. They appeared ... Read more Another tax filing season has passed, and the entire US accounting profession comes up for air. Of course, thousands of businesses and individuals have filed for extensions, thereby postponing the pain of calculating their final numbers for anywhere from a few days to six months. As the CPAs emerge from their winter burrows and blink in the sun, the rest of the business community reenergizes, suddenly able to move forward with planning and analysis that has been languishing while their numbers-crunchers were busy losing sleep and feasting on ramen noodles. I met with one firm about doing some valuation work in late February. They appeared ... Read more What is the Right Price? Of all the misconceptions by business owners, the ones surrounding their company’s value are both the most common and often wildly inaccurate. I’ve been working for the last couple of months on the training videos for advisors in our new product, The ExitMap®. (You can take the assessment for free at www.myexitmap.com). In one session, we role-play a vignette about a financial planner discussing the value of a business with a client planning retirement. Part of it goes something like this. Q: “So Bob, how much do you expect to realize from your business when you sell it?” A: “I’ve heard from my accountant that most small businesses sell ... Read more Of all the misconceptions by business owners, the ones surrounding their company’s value are both the most common and often wildly inaccurate. I’ve been working for the last couple of months on the training videos for advisors in our new product, The ExitMap®. (You can take the assessment for free at www.myexitmap.com). In one session, we role-play a vignette about a financial planner discussing the value of a business with a client planning retirement. Part of it goes something like this. Q: “So Bob, how much do you expect to realize from your business when you sell it?” A: “I’ve heard from my accountant that most small businesses sell ... Read more Is Your Business in the "Neutral Zone?" As Baby Boomers business owners approach retirement (the youngest of them turned 50 this year) they face a unique challenge. The market for small businesses is increasingly a buyer’s smorgasbord A shrinking middle-aged population, corporate competition for talent and less interest in the long hours associated with many traditional small businesses combine to make selling many Boomer enterprises a more difficult proposition. The best-of-class companies on both the smaller and larger end of the spectrum will still stand out as appealing propositions to buyers. On the main street side (companies selling for less than $3 million or so) there are still plenty of aspiring entrepreneurs who ... Read more As Baby Boomers business owners approach retirement (the youngest of them turned 50 this year) they face a unique challenge. The market for small businesses is increasingly a buyer’s smorgasbord A shrinking middle-aged population, corporate competition for talent and less interest in the long hours associated with many traditional small businesses combine to make selling many Boomer enterprises a more difficult proposition. The best-of-class companies on both the smaller and larger end of the spectrum will still stand out as appealing propositions to buyers. On the main street side (companies selling for less than $3 million or so) there are still plenty of aspiring entrepreneurs who ... Read more Owners Live in Two Different Worlds Business owners live in two different worlds. If you are a Baby Boomer, the title of this column might bring memories of any one of the many covers of the song by the same name. (Everyone from Nat King Cole to Roger Williams, and from Jerry Vale to Englebert Humperdinck recorded it.) My application of it in business refers to the chasm between those owners who plan to sell a business valued at less than $3 million, and those who have companies valued at more than that. In M&A parlance; “main street” and “mid-market” businesses. Some background is in order. I spent the week at two conferences. At the Business ... Read more Business owners live in two different worlds. If you are a Baby Boomer, the title of this column might bring memories of any one of the many covers of the song by the same name. (Everyone from Nat King Cole to Roger Williams, and from Jerry Vale to Englebert Humperdinck recorded it.) My application of it in business refers to the chasm between those owners who plan to sell a business valued at less than $3 million, and those who have companies valued at more than that. In M&A parlance; “main street” and “mid-market” businesses. Some background is in order. I spent the week at two conferences. At the Business ... Read more Selling Your Business in a Buyer's Market For almost ten years I’ve been writing and speaking about the issues facing Baby Boomer business owners as they begin a flood of small business sales. This recent article was syndicated in 16 trade and professional magazines. I reprint it here so readers of “Awake” can share it with their over-50 owner colleagues. More than 50% of US business owners are over 50 years old, and many of them are looking toward retirement and the process of attracting and vetting potential buyers to take the reins. The differences in yesterday’s and today’s business landscapes are stark—as Boomers were raised in a highly competitive environment, many ... Read more For almost ten years I’ve been writing and speaking about the issues facing Baby Boomer business owners as they begin a flood of small business sales. This recent article was syndicated in 16 trade and professional magazines. I reprint it here so readers of “Awake” can share it with their over-50 owner colleagues. More than 50% of US business owners are over 50 years old, and many of them are looking toward retirement and the process of attracting and vetting potential buyers to take the reins. The differences in yesterday’s and today’s business landscapes are stark—as Boomers were raised in a highly competitive environment, many ... Read more Money is Only Money Last week I discussed the general parameters of the private equity market for small and midsized businesses. A rational look at the number of “funds” active in the market, measured against the number of legitimate candidates for investment or acquisition, paints a clear view of why so many small companies are receiving calls from interested investors. There simply aren’t enough profitable, growing companies to buy. I put “funds” in quotes because not all Private Equity Groups are funds. There is a big difference between “We have money” and “We can get money.” Your first questions to any purported acquirer should be about the source and condition of their ... Read more Last week I discussed the general parameters of the private equity market for small and midsized businesses. A rational look at the number of “funds” active in the market, measured against the number of legitimate candidates for investment or acquisition, paints a clear view of why so many small companies are receiving calls from interested investors. There simply aren’t enough profitable, growing companies to buy. I put “funds” in quotes because not all Private Equity Groups are funds. There is a big difference between “We have money” and “We can get money.” Your first questions to any purported acquirer should be about the source and condition of their ... Read more Investing in Your Own Business: Will It Pay Off? A few months ago a business owner asked me to evaluate an acquisition offer for his small business. It was from a larger company headquartered in a different region of the country. They had a branch operation in his city, and wanted to expand their presence by combining it with his. For an opening offer, the deal seemed very reasonable to me. The purchase price was about four times EBITDA, with half in cash and half with interest over the next three years, and without any conditions attached. (note: That doesn’t mean conditions wouldn’t have come later.) He would receive a three-year employment agreement at a higher salary than he currently paid himself, ... Read more A few months ago a business owner asked me to evaluate an acquisition offer for his small business. It was from a larger company headquartered in a different region of the country. They had a branch operation in his city, and wanted to expand their presence by combining it with his. For an opening offer, the deal seemed very reasonable to me. The purchase price was about four times EBITDA, with half in cash and half with interest over the next three years, and without any conditions attached. (note: That doesn’t mean conditions wouldn’t have come later.) He would receive a three-year employment agreement at a higher salary than he currently paid himself, ... Read more Key Man Policies May Not Cover a Buy/Sell Agreement Over the last few weeks, I’ve had a number of conversations with clients about key man insurance. Let me say at the outset that I don’t sell insurance, and have no financial stake in whether any client has coverage or not. The use of such policies, however, may not always fit their intended purpose, especially in smaller companies. The most common intended purpose of a key man policy is to fund a buy/sell agreement. The benefit payment goes to the company, which in turn uses the proceeds to purchase ownership from the family or estate of the deceased. If it works that way, it’s an ... Read more Over the last few weeks, I’ve had a number of conversations with clients about key man insurance. Let me say at the outset that I don’t sell insurance, and have no financial stake in whether any client has coverage or not. The use of such policies, however, may not always fit their intended purpose, especially in smaller companies. The most common intended purpose of a key man policy is to fund a buy/sell agreement. The benefit payment goes to the company, which in turn uses the proceeds to purchase ownership from the family or estate of the deceased. If it works that way, it’s an ... Read more What is Your Company Worth? II Last week we discussed how business owners frequently use hearsay or incomplete information to estimate the value of their companies. They give the number to their financial planner, or include it on a personal financial statement for their banker, neither of whom bat an eyelash at the estimate. Having the amount “accepted” by financial experts, the owner starts to treat it as fact. How do you know whether it is realistic or achievable? Valuation of a small business is a combination of art and science. No two small companies are alike. A multiple of profits or cash flow is only the starting point. Take two small companies, ... Read more Last week we discussed how business owners frequently use hearsay or incomplete information to estimate the value of their companies. They give the number to their financial planner, or include it on a personal financial statement for their banker, neither of whom bat an eyelash at the estimate. Having the amount “accepted” by financial experts, the owner starts to treat it as fact. How do you know whether it is realistic or achievable? Valuation of a small business is a combination of art and science. No two small companies are alike. A multiple of profits or cash flow is only the starting point. Take two small companies, ... Read more The Gen X Business Buyer Generation X’ers aren’t mini-Boomers. Raised in a rapidly growing economy by parents that approached child rearing as a competitive activity, they saw more, did more, and were given more than their parents could have dreamed of. I took my first commercial airline ride when I was 25 years old (and before my mother’s first flight). My two sons had each boarded planes over 50 times before they were in high school. I was not an athlete, and have no hardware to display testifying to any athletic prowess. My youngest son made varsity in one sport, for one year. Yet he has a bookcase full of ... Read more Generation X’ers aren’t mini-Boomers. Raised in a rapidly growing economy by parents that approached child rearing as a competitive activity, they saw more, did more, and were given more than their parents could have dreamed of. I took my first commercial airline ride when I was 25 years old (and before my mother’s first flight). My two sons had each boarded planes over 50 times before they were in high school. I was not an athlete, and have no hardware to display testifying to any athletic prowess. My youngest son made varsity in one sport, for one year. Yet he has a bookcase full of ... Read more The X Factor There are two sides to every business transaction, a buyer and a seller. For most of the last 50 years in America, the Baby Boomers have been the biggest buyers in history. They bought homes and cars to spur the economy after World War II. They bought franchises to provide services for each other as busy parents. They bought SUVs and McMansions when they became the affluent middle-aged. Squeezed out of a corporate America that didn’t have room for them, and couldn’t offer the clear path to success they had been raised to expect, the Boomers formed new businesses in numbers unmatched before or since. In 1975, ... Read more There are two sides to every business transaction, a buyer and a seller. For most of the last 50 years in America, the Baby Boomers have been the biggest buyers in history. They bought homes and cars to spur the economy after World War II. They bought franchises to provide services for each other as busy parents. They bought SUVs and McMansions when they became the affluent middle-aged. Squeezed out of a corporate America that didn’t have room for them, and couldn’t offer the clear path to success they had been raised to expect, the Boomers formed new businesses in numbers unmatched before or since. In 1975, ... Read more The (pen)Ultimate Hire Every sane business owner will acknowledge that there is a point at which his or her own skills are no longer sufficient to grow the business beyond its current level. The revenue point where that happens differs by industry, but it frequently begins at around 20 employees. At that point, an owner becomes swamped by the conflicting needs of managing the existing operation, and having enough time to perform the tasks that made the business grow in the first place. The owner realizes that further growth requires the addition of a key employee; one who can assume some of the owner’s duties so that he or she can focus on ... Read more Every sane business owner will acknowledge that there is a point at which his or her own skills are no longer sufficient to grow the business beyond its current level. The revenue point where that happens differs by industry, but it frequently begins at around 20 employees. At that point, an owner becomes swamped by the conflicting needs of managing the existing operation, and having enough time to perform the tasks that made the business grow in the first place. The owner realizes that further growth requires the addition of a key employee; one who can assume some of the owner’s duties so that he or she can focus on ... Read more Another Lost Generation? I had the opportunity to present “Beating the Boomer Bust” twice this week, one of which was recorded for a Texas Public Radio show this weekend. For those who aren’t familiar with the piece, it discusses the massive changes that are unfolding as Boomers retire from their businesses. As usual, members of the audience said afterwards “I knew all those things, but I never thought through the implications before.” A quick recap before I get into today’s topic. “Beating the Boomer Bust” is a look at the perfect storm facing retiring owners who plan to sell their businesses. That largest small-business-owning group in history will ... Read more I had the opportunity to present “Beating the Boomer Bust” twice this week, one of which was recorded for a Texas Public Radio show this weekend. For those who aren’t familiar with the piece, it discusses the massive changes that are unfolding as Boomers retire from their businesses. As usual, members of the audience said afterwards “I knew all those things, but I never thought through the implications before.” A quick recap before I get into today’s topic. “Beating the Boomer Bust” is a look at the perfect storm facing retiring owners who plan to sell their businesses. That largest small-business-owning group in history will ... Read more Three Circles of Family Business What is a “Family Business?” A large percentage of small companies have some family involved. For most, it is simple a case of providing employment to family members. If the founder of the company is also the principle revenue generator, it may be a spouse (most often the wife) who keeps the books and runs the office. Employment of children who can’t (or won’t) find another job is common, and more so in the current economy. In most instances it is just a matter of income transfer with some value attached. The owner could keep handing over money for the child’s living expenses, but he or ... Read more What is a “Family Business?” A large percentage of small companies have some family involved. For most, it is simple a case of providing employment to family members. If the founder of the company is also the principle revenue generator, it may be a spouse (most often the wife) who keeps the books and runs the office. Employment of children who can’t (or won’t) find another job is common, and more so in the current economy. In most instances it is just a matter of income transfer with some value attached. The owner could keep handing over money for the child’s living expenses, but he or ... Read more Lifestyle or Legacy - Part 4Last week a client told me “You are wrong. I have a lifestyle business that is ALSO a legacy business.” Sorry, but that doesn’t fly. He has built a good company, and continues to improve it. Be he is not driving to make it into something that carries on beyond him. His objective is to (eventually) make it large enough to be acquired, and for enough money to live in luxury for the rest of his life. That is a lifestyle business. It’s only purpose is to fund the financial aspirations of the owner. There is no larger purpose, no overarching vision of something beyond his ... Read more |