Your ExitMap Blog Contributor

Your ExitMap Blog Contributor

Exit Planning Articles by John F. Dini, CBEC, CExP, CEPA

John F. Dini, CBEC, CExP, CEPA

John F. Dini, CBEC, CExP, CEPAPresident, MPN Incorporated

Complete an MPN Inc. Exit Readiness Assessment

John F. Dini develops transition and succession strategies that allow business owners to exit their companies on their own schedule, with the proceeds they seek and complete control over the process. He takes a coaching approach to client engagements, focusing on helping owners of companies with $1M to $250M in revenue achieve both their desired lifestyles and legacies.

Recent Articles posted by John F. Dini

| Recent Articles posted by John F. Dini |

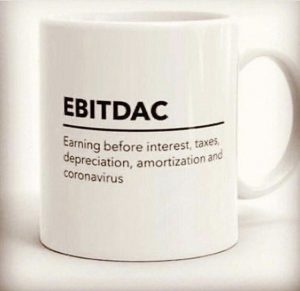

When Kids Don't Cut It Many owners want to see their children inherit the business, but what happens when the kids don’t cut it? Some years ago I worked with a business owner whose exit plan was to sell into one of the private equity roll-ups that were active in his industry. His son was finishing college, where he studied for a career in wildlife management. The son’s ambition was to spend his life in the great outdoors. One day my client was beaming when I walked into his office. “Guess what?” he said. “My son called. He wants to take over my business!” After a few minutes, it was ... Read more Many owners want to see their children inherit the business, but what happens when the kids don’t cut it? Some years ago I worked with a business owner whose exit plan was to sell into one of the private equity roll-ups that were active in his industry. His son was finishing college, where he studied for a career in wildlife management. The son’s ambition was to spend his life in the great outdoors. One day my client was beaming when I walked into his office. “Guess what?” he said. “My son called. He wants to take over my business!” After a few minutes, it was ... Read more Your Exit Plan: The 3 Inarguable Reasons to Start NOW What is Your Exit Plan? If you’ve ever done a business plan for the purpose of raising capital, one of the key questions is “What is your exit plan?” Many business owners think that question is self-serving, intended merely to let the venture capitalists figure when and how they will get their return on investment. In truth, however, that question is far more important. An exit plan is a strategic plan with an end date. Putting a time frame on your plan, and defining the goals to be achieved by that date, creates a future-focused mindset for the owner. It controls and reduces your tendency ... Read more What is Your Exit Plan? If you’ve ever done a business plan for the purpose of raising capital, one of the key questions is “What is your exit plan?” Many business owners think that question is self-serving, intended merely to let the venture capitalists figure when and how they will get their return on investment. In truth, however, that question is far more important. An exit plan is a strategic plan with an end date. Putting a time frame on your plan, and defining the goals to be achieved by that date, creates a future-focused mindset for the owner. It controls and reduces your tendency ... Read more EBITDAC : What is Your Business Worth Now? Several friends have sent me a picture of an EBITDAC coffee mug this week. As it states, EBITDAC stands for Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus. Will this be the new measure of cash flow for valuing your business? A bleak joke, but one that is on the minds of many business owners, especially Baby Boomers in their late 50s and 60s. Many were postponing their exit planning because business has been so good. As one client told me, “In March we had the best year in the history of my company. It looks like April might be the worst.” Downturns aren’t new, ... Read more Several friends have sent me a picture of an EBITDAC coffee mug this week. As it states, EBITDAC stands for Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus. Will this be the new measure of cash flow for valuing your business? A bleak joke, but one that is on the minds of many business owners, especially Baby Boomers in their late 50s and 60s. Many were postponing their exit planning because business has been so good. As one client told me, “In March we had the best year in the history of my company. It looks like April might be the worst.” Downturns aren’t new, ... Read more Exit Planning in a Crisis Why would you be exit planning in a crisis? At the height of the economic expansion (a few months ago in late 2019) I was reviewing a company’s financial statements. Their sales were stagnant, and profits were minimal. When I asked the owner why his business hadn’t grown, he responded, “Well, the Great Recession hit our industry pretty hard, you know.” Take note that it wasn’t his fault. He was in a hard-hit industry, and the economy dealt him a bad hand. He ignored the thousands of businesses just like his that had grown and prospered in the last ten years. Once you hunker down ... Read more Why would you be exit planning in a crisis? At the height of the economic expansion (a few months ago in late 2019) I was reviewing a company’s financial statements. Their sales were stagnant, and profits were minimal. When I asked the owner why his business hadn’t grown, he responded, “Well, the Great Recession hit our industry pretty hard, you know.” Take note that it wasn’t his fault. He was in a hard-hit industry, and the economy dealt him a bad hand. He ignored the thousands of businesses just like his that had grown and prospered in the last ten years. Once you hunker down ... Read more Quarterbacking is Not Exit Planning Quarterbacking is a popular term when exit planners are talking to clients. It’s supposed to invoke a vision of someone who is in control. Think about a Tom Brady, Aaron Rodgers or Patrick Mahomes standing tall in the pocket, surveying the offense and defense unfolding before him. There is a real problem with using “Quarterbacking” when referring to your exit planning professional team. The quarterback calls the plays. The job of the rest of the team is to run them as instructed. I’ve yet to meet a CPA or attorney who thinks that is the best way to develop a client’s exit plan. Teamwork Exit ... Read more Quarterbacking is a popular term when exit planners are talking to clients. It’s supposed to invoke a vision of someone who is in control. Think about a Tom Brady, Aaron Rodgers or Patrick Mahomes standing tall in the pocket, surveying the offense and defense unfolding before him. There is a real problem with using “Quarterbacking” when referring to your exit planning professional team. The quarterback calls the plays. The job of the rest of the team is to run them as instructed. I’ve yet to meet a CPA or attorney who thinks that is the best way to develop a client’s exit plan. Teamwork Exit ... Read more |