Your ExitMap Blog gathers contributions from top exit planning professionals across the country that are indexed into four categories. They include select strategies for planning your exit, ideas for building your company’s value, transfer options you can choose from, or preparing to enjoy your post-exit lifestyle. This page shows the most recent posts from Your ExitMap Blog. If you are seeking a qualified exit planning professional, you can view a map of specialists here.

All articles are copyrighted by the authors, and reprinted here with permission. Each author’s contact information is available via a link at the end of the article.

Most Recent Your ExitMap Blog Articles

Most Recent Blog Articles

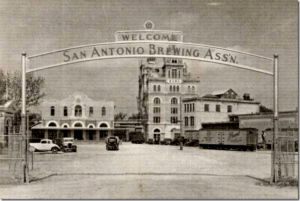

Death, Taxes and Exit Planning (This post was published in the Sageworks/ProfitCents blog earlier this week) Understanding the Post-Ownership Void As advisors, we understand that our business clients should be preparing for the biggest financial event of their lives – the sale of their business. However, when we ask, “How are you exit planning for your retirement from the business?” we seldom get a straight answer. Instead, we get any number of comments like: “I still enjoy my business, I’m not thinking about it right now.” “I have a good company. I can sell it whenever I choose.” “Everything is available for the right price. I just haven’t heard it ... Read more (This post was published in the Sageworks/ProfitCents blog earlier this week) Understanding the Post-Ownership Void As advisors, we understand that our business clients should be preparing for the biggest financial event of their lives – the sale of their business. However, when we ask, “How are you exit planning for your retirement from the business?” we seldom get a straight answer. Instead, we get any number of comments like: “I still enjoy my business, I’m not thinking about it right now.” “I have a good company. I can sell it whenever I choose.” “Everything is available for the right price. I just haven’t heard it ... Read more Employee Retention Before and After Your Exit In most businesses, employee retention is a material factor in valuation and transferability. The ability of a buyer to assume control of a fully-functional organization has substantial influence on his or her perception of a company’s value. Any need to pay the seller for an extended period of training adds a redundant executive salary to the projected operating costs. Concern that key personnel may resign or be recruited away by a competitor adds a level of uncertainty to the transfer. Of course, the basic premise of “The more you work in the business, the less it is worth.” always applies. Even if you’ve effectively delegated most of ... Read more In most businesses, employee retention is a material factor in valuation and transferability. The ability of a buyer to assume control of a fully-functional organization has substantial influence on his or her perception of a company’s value. Any need to pay the seller for an extended period of training adds a redundant executive salary to the projected operating costs. Concern that key personnel may resign or be recruited away by a competitor adds a level of uncertainty to the transfer. Of course, the basic premise of “The more you work in the business, the less it is worth.” always applies. Even if you’ve effectively delegated most of ... Read more Celebrating Mr. Fezziwig To celebrate the holiday, I’m reprinting a post from 2013 about the underappreciated boss of A Christmas Carol, Mr. Fezziwig. I hope that you enjoy it. Merry Christmas! Last week was the 170th anniversary of the publication of Charles Dickens’ A Christmas Carol (December 17, 1843). The immortal words of Ebenezer Scrooge are ingrained in the memory of the entire English speaking world. I’d venture to guess that “Bah, Humbug!” can be correctly identified as to source and speaker by over 99% of those reading this. The novella, serialized in five parts, was not a commercial success. Unhappy with the sales of his previous novel (Martin Chuzzlewit– no wonder!), ... Read more To celebrate the holiday, I’m reprinting a post from 2013 about the underappreciated boss of A Christmas Carol, Mr. Fezziwig. I hope that you enjoy it. Merry Christmas! Last week was the 170th anniversary of the publication of Charles Dickens’ A Christmas Carol (December 17, 1843). The immortal words of Ebenezer Scrooge are ingrained in the memory of the entire English speaking world. I’d venture to guess that “Bah, Humbug!” can be correctly identified as to source and speaker by over 99% of those reading this. The novella, serialized in five parts, was not a commercial success. Unhappy with the sales of his previous novel (Martin Chuzzlewit– no wonder!), ... Read more Life After Exit -- Time is of the Essence From time to time, we share real stories about life after exit from owners who have sold their businesses. Some are great and some… not so much. The have agreed to share their experiences to help other owners prepare for both the process of transferring their companies and what comes after. The Business BVA Scientific, a distributor of laboratory supplies and equipment, started in Bob and Nancy Davison’s bedroom with the garage serving as the “warehouse.” Both had a background in laboratory supply sales, and they focused on building deeper customer relationships than the multi-billion dollar vendors who dominate the industry. That approach helped the ... Read more From time to time, we share real stories about life after exit from owners who have sold their businesses. Some are great and some… not so much. The have agreed to share their experiences to help other owners prepare for both the process of transferring their companies and what comes after. The Business BVA Scientific, a distributor of laboratory supplies and equipment, started in Bob and Nancy Davison’s bedroom with the garage serving as the “warehouse.” Both had a background in laboratory supply sales, and they focused on building deeper customer relationships than the multi-billion dollar vendors who dominate the industry. That approach helped the ... Read more Exit Planning - Maintaining Control For many owners, their biggest concern in an exit plan is maintaining control. Whether they seek to sell to employees, family or a third-party, there is a fear that, once started, the process will have its own rules and momentum. My colleague John Warrillow, author of Built to Sell and The Automatic Customer, has written an excellent white paper on the types of people who own businesses. John previously owned a data-driven marketing company, and always backs up his opinions with solid research. I’ll leave the indicators of the entrepreneurial types to John, since it is his material. His conclusion, however, is that 2% of owners are Mountain Climbers. ... Read more For many owners, their biggest concern in an exit plan is maintaining control. Whether they seek to sell to employees, family or a third-party, there is a fear that, once started, the process will have its own rules and momentum. My colleague John Warrillow, author of Built to Sell and The Automatic Customer, has written an excellent white paper on the types of people who own businesses. John previously owned a data-driven marketing company, and always backs up his opinions with solid research. I’ll leave the indicators of the entrepreneurial types to John, since it is his material. His conclusion, however, is that 2% of owners are Mountain Climbers. ... Read more Choosing Your Timeframe to Exit “My timeframe? Talk to me in about five years.” When business owners are asked about exit planning, that answer is almost ubiquitous. In fact, a much-quoted 2008 survey of owners by Price Waterhouse Coopers (now PwC – not clear why Mr. Waterhouse warranted lower case) found that 85% of private business owners said they expected to sell in five years. Clearly, that didn’t happen, since it would have required some 1,500 businesses to be sold daily during that period. (The brokerage industry claims about 9,000 sales a year.) In fact, when the survey results were broken down, they discovered that 85% of 60 year old owners ... Read more “My timeframe? Talk to me in about five years.” When business owners are asked about exit planning, that answer is almost ubiquitous. In fact, a much-quoted 2008 survey of owners by Price Waterhouse Coopers (now PwC – not clear why Mr. Waterhouse warranted lower case) found that 85% of private business owners said they expected to sell in five years. Clearly, that didn’t happen, since it would have required some 1,500 businesses to be sold daily during that period. (The brokerage industry claims about 9,000 sales a year.) In fact, when the survey results were broken down, they discovered that 85% of 60 year old owners ... Read more About YourExitMap.com About YourExitMap.com for Business Owners YourExitMap.com contains a growing library of interactive tools, educational materials and practical exit planning resources for business owners. The content is designed to be engaging and entertaining, and deliver valuable information about the most influential factor in a successful transition strategy. Is your business prepared to generate the value needed to fund your retirement goals? Use the companion resource, Your Exit Map: Navigating the Boomer Bust by John F. Dini, to guide you through the generation of real-time results using the ExitMap tools and your actual numbers. Contact Information Physical and Mailing Address: MPN Inc. | 15600 San Pedro ... Read more About YourExitMap.com for Business Owners YourExitMap.com contains a growing library of interactive tools, educational materials and practical exit planning resources for business owners. The content is designed to be engaging and entertaining, and deliver valuable information about the most influential factor in a successful transition strategy. Is your business prepared to generate the value needed to fund your retirement goals? Use the companion resource, Your Exit Map: Navigating the Boomer Bust by John F. Dini, to guide you through the generation of real-time results using the ExitMap tools and your actual numbers. Contact Information Physical and Mailing Address: MPN Inc. | 15600 San Pedro ... Read more Internal Transfers: Legacy vs. Lucre Lifestyle vs. Legacy Why would I refer to the results of an internal transfer as “lifestyle vs. lucre?” Lucre is a pejorative term. While it is technically just a synonym for money, most dictionaries draw the parallel to its use in “filthy lucre;” money that is ill-gotten or otherwise dishonorably obtained. I was honored to present at the Exit Planning Summit this past weekend. One of the things I discussed was the need to help business owners determine whether their personal vision for their company’s future was based on lifestyle or legacy. That’s how I normally term it, and there is no negative connotation attached to either ... Read more Lifestyle vs. Legacy Why would I refer to the results of an internal transfer as “lifestyle vs. lucre?” Lucre is a pejorative term. While it is technically just a synonym for money, most dictionaries draw the parallel to its use in “filthy lucre;” money that is ill-gotten or otherwise dishonorably obtained. I was honored to present at the Exit Planning Summit this past weekend. One of the things I discussed was the need to help business owners determine whether their personal vision for their company’s future was based on lifestyle or legacy. That’s how I normally term it, and there is no negative connotation attached to either ... Read more The Right Price for Your Business “If someone offered me the right price, I’d sell in a minute!” Exit planners and business brokers hear it all the time. “Anything is for sale if the price is right!” What is the “right” price? Of course, you can fantasize about a windfall from a buyer who has far more money than brains. Some of the fast-talking “business brokers” (the ones who get more revenue from preparing offering books than actually selling companies), will pitch their secret list of buyers in Europe and Asia who routinely overpay for businesses. In case you didn’t know, the largest advisory firms in Europe and Asia are the same ones ... Read more “If someone offered me the right price, I’d sell in a minute!” Exit planners and business brokers hear it all the time. “Anything is for sale if the price is right!” What is the “right” price? Of course, you can fantasize about a windfall from a buyer who has far more money than brains. Some of the fast-talking “business brokers” (the ones who get more revenue from preparing offering books than actually selling companies), will pitch their secret list of buyers in Europe and Asia who routinely overpay for businesses. In case you didn’t know, the largest advisory firms in Europe and Asia are the same ones ... Read more After the Exit: Second Acts As part of my effort to add variety to the types of exit planning posts here, I will occasionally include “Second Act”, stories about business owners who have already left one career, and are now doing something else. The Second Act The 19th century Pearl Brewery exemplified both the potential and the problems of close-in urban industrial sites. Long abandoned, but just a mile or so along the river from the famed San Antonio Riverwalk, it was in the words of one real estate agent (quoted from the San Antonio Express-News): “…an overgrown creek full of homeless encampments. There was terrible crime in the area, ... Read more As part of my effort to add variety to the types of exit planning posts here, I will occasionally include “Second Act”, stories about business owners who have already left one career, and are now doing something else. The Second Act The 19th century Pearl Brewery exemplified both the potential and the problems of close-in urban industrial sites. Long abandoned, but just a mile or so along the river from the famed San Antonio Riverwalk, it was in the words of one real estate agent (quoted from the San Antonio Express-News): “…an overgrown creek full of homeless encampments. There was terrible crime in the area, ... Read more |

|

Keystone Content: Are you just beginning your exit planning journey? Here are two short articles from Your ExitMap Blog to help get you started. 3 Inarguable Reasons How prepared are you to Take a FREE 15-minute FIND A QUALIFIED EXIT PLANNER |