Your ExitMap Blog gathers contributions from top exit planning professionals across the country that are indexed into four categories. They include select strategies for planning your exit, ideas for building your company’s value, transfer options you can choose from, or preparing to enjoy your post-exit lifestyle. This page shows the most recent posts from Your ExitMap Blog. If you are seeking a qualified exit planning professional, you can view a map of specialists here.

All articles are copyrighted by the authors, and reprinted here with permission. Each author’s contact information is available via a link at the end of the article.

Most Recent Your ExitMap Blog Articles

Most Recent Blog Articles

Private Equity Reputation We began this series by saying that Private Equity reputation is as the Great Satan to some, and a savior to others, depending on the personal experience of the speakers. In fact, both reputations are well deserved, but neither can be universally applied.

The “Great Satan” Private Equity Reputation - PEGs buy companies for the express purpose of improving their performance. That often comes with considerable pain for employees. We began this series by saying that Private Equity reputation is as the Great Satan to some, and a savior to others, depending on the personal experience of the speakers. In fact, both reputations are well deserved, but neither can be universally applied.

The “Great Satan” Private Equity Reputation - PEGs buy companies for the express purpose of improving their performance. That often comes with considerable pain for employees. Private Equity Leverage Private equity leverage can dramatically increase ROI, but it can also be a trap. In our previous article, we discussed the general structure of Private Equity, how it works, and the types of Private Equity Groups (PEGs). They have grown rapidly as an alternative investment that produces far better returns than Treasury Bills or publicly traded equities. Private equity leverage can dramatically increase ROI, but it can also be a trap. In our previous article, we discussed the general structure of Private Equity, how it works, and the types of Private Equity Groups (PEGs). They have grown rapidly as an alternative investment that produces far better returns than Treasury Bills or publicly traded equities. Private Equity and Privately Held Businesses Depending on who you are talking to, Private Equity is either the Great Satan or the savior of small and mid-market companies in the United States. The stories depend a lot on the personal experience of the speakers. Depending on who you are talking to, Private Equity is either the Great Satan or the savior of small and mid-market companies in the United States. The stories depend a lot on the personal experience of the speakers. It’s Fall, or as Some Say, “Football Season” - How Succession and Exit Planning Mirror Winning the Big Game Fall brings crisp air, colorful leaves, and the undeniable excitement of football season. And much like football, where great individual players exist, the game’s heart and soul lie in teamwork. No matter how talented a quarterback or running back is, they can’t win the game alone. Victory requires everyone—linemen, defense, special teams, and coaches—working together toward a shared goal. Succession and exit planning for business owners are strikingly similar. Fall brings crisp air, colorful leaves, and the undeniable excitement of football season. And much like football, where great individual players exist, the game’s heart and soul lie in teamwork. No matter how talented a quarterback or running back is, they can’t win the game alone. Victory requires everyone—linemen, defense, special teams, and coaches—working together toward a shared goal. Succession and exit planning for business owners are strikingly similar.

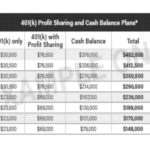

A Cash Balance Plan May be a Great Tax- Reducing Benefit to A Business Owner Like most business owners, you’re likely exploring ways to strategically grow your revenue, increase profits, and minimize taxes. This is a common goal. As your cash flows increase, you may find yourself seeking ways to reduce your growing tax burden. Often, we explore sensible capital expenditures or business reinvestments that align with your strategic goals, which is a healthy exercise. Like most business owners, you’re likely exploring ways to strategically grow your revenue, increase profits, and minimize taxes. This is a common goal. As your cash flows increase, you may find yourself seeking ways to reduce your growing tax burden. Often, we explore sensible capital expenditures or business reinvestments that align with your strategic goals, which is a healthy exercise. Owning Change: Continuity Planning for Businesses in Ownership Transitions Ownership changes are critical moments in the life of any business. Whether due to the untimely death of an owner, the departure of a sole owner, or the exit of a co-owner in a multi-owner business, these transitions present unique challenges that require thoughtful planning. Effective continuity planning can help ensure that a business not only survives but thrives through these transitions. Ownership changes are critical moments in the life of any business. Whether due to the untimely death of an owner, the departure of a sole owner, or the exit of a co-owner in a multi-owner business, these transitions present unique challenges that require thoughtful planning. Effective continuity planning can help ensure that a business not only survives but thrives through these transitions. My Interview with Jerry West on Management I once had the thrill of interviewing Jerry West on management. He was “The Logo” for the NBA, although back then they didn’t advertise him as such. Only the Laker followers knew for sure.

Jerry WestIn 1989 the “Showtime” Lakers were coming off back-to-back championships. Pat Riley was a year away from his first of three Coach of the Year awards. Jerry was the GM. Many people don’t know this, but starting when Jerry West was drafted in 1960 until he stepped out of the GM role in 2002, the Lakers only missed the playoffs twice. Those seasons (74-75 and 75-76) were the only two seasons out of 42 that West was not on the Laker payroll. I once had the thrill of interviewing Jerry West on management. He was “The Logo” for the NBA, although back then they didn’t advertise him as such. Only the Laker followers knew for sure.

Jerry WestIn 1989 the “Showtime” Lakers were coming off back-to-back championships. Pat Riley was a year away from his first of three Coach of the Year awards. Jerry was the GM. Many people don’t know this, but starting when Jerry West was drafted in 1960 until he stepped out of the GM role in 2002, the Lakers only missed the playoffs twice. Those seasons (74-75 and 75-76) were the only two seasons out of 42 that West was not on the Laker payroll. Seize The Moment: Strategically Timing Your Retirement When Selling Your Business Imagine standing at the edge of a cliff, ready to take a leap into a new chapter of your life. That’s retirement. Now, picture this adventure interwoven with the sale of your business. Exciting, right? Just like any daring journey, timing is everything. Let’s talk about finding that perfect moment to embark on your retirement while selling your business. It’s not just about calendars and clocks; it’s about aligning the stars to make the most of your hard-earned efforts. Imagine standing at the edge of a cliff, ready to take a leap into a new chapter of your life. That’s retirement. Now, picture this adventure interwoven with the sale of your business. Exciting, right? Just like any daring journey, timing is everything. Let’s talk about finding that perfect moment to embark on your retirement while selling your business. It’s not just about calendars and clocks; it’s about aligning the stars to make the most of your hard-earned efforts. Are You Financially Ready to Exit Your Business Even if it Happened Tomorrow? Exiting a business is a significant decision that requires careful consideration, particularly regarding financial readiness. Whether you’re considering retirement, pursuing new ventures, or simply ready to move on, being financially prepared is crucial for a smooth transition. Exiting a business is a significant decision that requires careful consideration, particularly regarding financial readiness. Whether you’re considering retirement, pursuing new ventures, or simply ready to move on, being financially prepared is crucial for a smooth transition. Business Continuity Planning A business continuity plan is a document that contains everything needed to successfully preserve the company’s value in the event of an owner’s death or incapacitation. There are 2 parts of a good plan. The first is the information that the family and employees need to keep the business going over the short term. The other is a longer-term strategy for the company in the event that the owner will be permanently absent. A business continuity plan is a document that contains everything needed to successfully preserve the company’s value in the event of an owner’s death or incapacitation. There are 2 parts of a good plan. The first is the information that the family and employees need to keep the business going over the short term. The other is a longer-term strategy for the company in the event that the owner will be permanently absent. |

|

Keystone Content: Are you just beginning your exit planning journey? Here are two short articles from Your ExitMap Blog to help get you started. 3 Inarguable Reasons How prepared are you to Take a FREE 15-minute FIND A QUALIFIED EXIT PLANNER |