Your ExitMap Blog gathers contributions from top exit planning professionals across the country that are indexed into four categories. They include select strategies for planning your exit, ideas for building your company’s value, transfer options you can choose from, or preparing to enjoy your post-exit lifestyle. This page shows the most recent posts from Your ExitMap Blog. If you are seeking a qualified exit planning professional, you can view a map of specialists here.

All articles are copyrighted by the authors, and reprinted here with permission. Each author’s contact information is available via a link at the end of the article.

Most Recent Your ExitMap Blog Articles

Most Recent Blog Articles

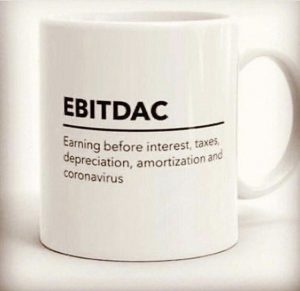

Are You Prepared for the Next Stage of Your Business? You’re a successful business owner who’s devoted all your time and effort to growing your company to be a best-in-class provider in the industry. With your head down so long, you’ve probably never thought about what you were going to do as you approached the next stage of life. Planning for that next stage before you actually get there can help solve many of the problems today’s business owners often face following an exit transaction. It may sound great to play golf every day, or to sit at the lake and fish, but does that replace the daily rush you had while operating your business? ... Read more You’re a successful business owner who’s devoted all your time and effort to growing your company to be a best-in-class provider in the industry. With your head down so long, you’ve probably never thought about what you were going to do as you approached the next stage of life. Planning for that next stage before you actually get there can help solve many of the problems today’s business owners often face following an exit transaction. It may sound great to play golf every day, or to sit at the lake and fish, but does that replace the daily rush you had while operating your business? ... Read more The Dismal Ds and Exit Planning The “Dismal Ds” is an inside joke in exit planning. Every industry and profession has them. In some, it’s “You can have it done well, done fast, or done cheaply. Pick any two.” In planning it’s “Sooner or later, every owner exits his or her business… 100% guaranteed.” Clearly, that refers to the unplanned but inevitable departure from the biggest D – Death. That isn’t the only D, however. There are others, NONE of which lead to a controlled, lucrative, or enjoyable transition. Most start with dis- defined as “dis– 1. a Latin prefix meaning “apart,” “asunder,” “away,” “utterly,” or having a privative, negative, or reversing force.” ... Read more The “Dismal Ds” is an inside joke in exit planning. Every industry and profession has them. In some, it’s “You can have it done well, done fast, or done cheaply. Pick any two.” In planning it’s “Sooner or later, every owner exits his or her business… 100% guaranteed.” Clearly, that refers to the unplanned but inevitable departure from the biggest D – Death. That isn’t the only D, however. There are others, NONE of which lead to a controlled, lucrative, or enjoyable transition. Most start with dis- defined as “dis– 1. a Latin prefix meaning “apart,” “asunder,” “away,” “utterly,” or having a privative, negative, or reversing force.” ... Read more Succession Planning Starts with "What’s Next" Asking the Right Question What makes a business successful? In many small businesses, the owner is the principal driver, particularly from a technical and sales aspect. They are the ones running around, coordinating sales, staying late to ensure that products get made. They are the ones working the relationships with clients to ensure that the orders continue to come in. With all that these individuals is doing, exit planners ask, “have they ever thought about what they want to do next?” Unfortunately, there is a good chance that one of the 5 D’s (Death, Divorce, Disability, Distress, and Disagreement) could affect their businesses. Let us ... Read more Asking the Right Question What makes a business successful? In many small businesses, the owner is the principal driver, particularly from a technical and sales aspect. They are the ones running around, coordinating sales, staying late to ensure that products get made. They are the ones working the relationships with clients to ensure that the orders continue to come in. With all that these individuals is doing, exit planners ask, “have they ever thought about what they want to do next?” Unfortunately, there is a good chance that one of the 5 D’s (Death, Divorce, Disability, Distress, and Disagreement) could affect their businesses. Let us ... Read more Preserving Family Wealth is a Generational Effort Wealth within a family can be a double-edged sword. It can serve as an incredible resource to benefit its family members, but it can also be destructive and divisive. Destructive in the sense that if not properly tended to and respected, wealth can destroy the purpose and outcomes of individual family members, and divisive in the sense that it can damage the bond between family members and cause a splintering of the family. Wealth and the handling of wealth is a topic that has been discussed or written about throughout the ages, as it is mentioned in both the Old Testament and the Gospels within ... Read more Wealth within a family can be a double-edged sword. It can serve as an incredible resource to benefit its family members, but it can also be destructive and divisive. Destructive in the sense that if not properly tended to and respected, wealth can destroy the purpose and outcomes of individual family members, and divisive in the sense that it can damage the bond between family members and cause a splintering of the family. Wealth and the handling of wealth is a topic that has been discussed or written about throughout the ages, as it is mentioned in both the Old Testament and the Gospels within ... Read more When Kids Don't Cut It Many owners want to see their children inherit the business, but what happens when the kids don’t cut it? Some years ago I worked with a business owner whose exit plan was to sell into one of the private equity roll-ups that were active in his industry. His son was finishing college, where he studied for a career in wildlife management. The son’s ambition was to spend his life in the great outdoors. One day my client was beaming when I walked into his office. “Guess what?” he said. “My son called. He wants to take over my business!” After a few minutes, it was ... Read more Many owners want to see their children inherit the business, but what happens when the kids don’t cut it? Some years ago I worked with a business owner whose exit plan was to sell into one of the private equity roll-ups that were active in his industry. His son was finishing college, where he studied for a career in wildlife management. The son’s ambition was to spend his life in the great outdoors. One day my client was beaming when I walked into his office. “Guess what?” he said. “My son called. He wants to take over my business!” After a few minutes, it was ... Read more An Often Neglected Means Of Protecting Business Value Protect The Business Most Valuable Asset A compelling and common characteristic of successful business owners is optimism. The “glass is always half full” attitude results in the risk-taking, perseverance, and innovation it takes to build, grow, and protect a successful business. Like any personal strength, this optimism can quickly become a weakness when there is a need to plan for the gloomy business contingencies of death and disability. What happens to the business due to either of these less than optimistic events is the last thing an optimistic owner wants to think about. Some might say that perhaps owners don’t care if the business fails ... Read more Protect The Business Most Valuable Asset A compelling and common characteristic of successful business owners is optimism. The “glass is always half full” attitude results in the risk-taking, perseverance, and innovation it takes to build, grow, and protect a successful business. Like any personal strength, this optimism can quickly become a weakness when there is a need to plan for the gloomy business contingencies of death and disability. What happens to the business due to either of these less than optimistic events is the last thing an optimistic owner wants to think about. Some might say that perhaps owners don’t care if the business fails ... Read more Succession Planning or Exit Planning? Small Business Owners Need Both! One of the questions we often hear from business owners is, “What is the difference between Succession Planning and Exit Planning? Aren’t they the same thing?” Surprisingly, they are not. The next question usually is, “Which one do I need?” The answer is simple. Whether the business is small or large, family-owned or not, astute business owners always need both. Nearly $10 trillion dollars in business assets will be transferred globally in the next decade, according to Forbes Magazine. Baby Boomers selling privately owned businesses or transferring them to family members will comprise much of that $10 trillion dollar transfer. As the market becomes crowded ... Read more One of the questions we often hear from business owners is, “What is the difference between Succession Planning and Exit Planning? Aren’t they the same thing?” Surprisingly, they are not. The next question usually is, “Which one do I need?” The answer is simple. Whether the business is small or large, family-owned or not, astute business owners always need both. Nearly $10 trillion dollars in business assets will be transferred globally in the next decade, according to Forbes Magazine. Baby Boomers selling privately owned businesses or transferring them to family members will comprise much of that $10 trillion dollar transfer. As the market becomes crowded ... Read more Your Exit Plan: The 3 Inarguable Reasons to Start NOW What is Your Exit Plan? If you’ve ever done a business plan for the purpose of raising capital, one of the key questions is “What is your exit plan?” Many business owners think that question is self-serving, intended merely to let the venture capitalists figure when and how they will get their return on investment. In truth, however, that question is far more important. An exit plan is a strategic plan with an end date. Putting a time frame on your plan, and defining the goals to be achieved by that date, creates a future-focused mindset for the owner. It controls and reduces your tendency ... Read more What is Your Exit Plan? If you’ve ever done a business plan for the purpose of raising capital, one of the key questions is “What is your exit plan?” Many business owners think that question is self-serving, intended merely to let the venture capitalists figure when and how they will get their return on investment. In truth, however, that question is far more important. An exit plan is a strategic plan with an end date. Putting a time frame on your plan, and defining the goals to be achieved by that date, creates a future-focused mindset for the owner. It controls and reduces your tendency ... Read more Protect Your Business with A Solid Continuity Plan The Need For A Solid Continuity Plan A great characteristic of successful business owners is that they are optimistic people and will do what it takes to protect their business. They have a can-do attitude, setting their goals high, taking risks, hiring the right people, constantly striving to improve the delivery of their service or product, with a constant drive to build their entity into one of great significance. As a result, building a successful company may give the owner great pride in their achievements and a strong sense of identity. That is normal human behavior. But because of that, the thought of an event ... Read more The Need For A Solid Continuity Plan A great characteristic of successful business owners is that they are optimistic people and will do what it takes to protect their business. They have a can-do attitude, setting their goals high, taking risks, hiring the right people, constantly striving to improve the delivery of their service or product, with a constant drive to build their entity into one of great significance. As a result, building a successful company may give the owner great pride in their achievements and a strong sense of identity. That is normal human behavior. But because of that, the thought of an event ... Read more EBITDAC : What is Your Business Worth Now? Several friends have sent me a picture of an EBITDAC coffee mug this week. As it states, EBITDAC stands for Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus. Will this be the new measure of cash flow for valuing your business? A bleak joke, but one that is on the minds of many business owners, especially Baby Boomers in their late 50s and 60s. Many were postponing their exit planning because business has been so good. As one client told me, “In March we had the best year in the history of my company. It looks like April might be the worst.” Downturns aren’t new, ... Read more Several friends have sent me a picture of an EBITDAC coffee mug this week. As it states, EBITDAC stands for Earnings Before Interest, Taxes, Depreciation, Amortization and Coronavirus. Will this be the new measure of cash flow for valuing your business? A bleak joke, but one that is on the minds of many business owners, especially Baby Boomers in their late 50s and 60s. Many were postponing their exit planning because business has been so good. As one client told me, “In March we had the best year in the history of my company. It looks like April might be the worst.” Downturns aren’t new, ... Read more |

|

Keystone Content: Are you just beginning your exit planning journey? Here are two short articles from Your ExitMap Blog to help get you started. 3 Inarguable Reasons How prepared are you to Take a FREE 15-minute FIND A QUALIFIED EXIT PLANNER |