Your ExitMap Seller’s Valuation Sanity Check©

Your ExitMap Seller’s Valuation Sanity Check©

An Exit Planning Tool for Reviewing the Financial Parameters of a Sale

Your ExitMap Interactive Tools:

The Seller’s Valuation Sanity Check

How realistic is your anticipated selling price?

Every transaction is made possible by the cash flow of the company. The Seller’s Valuation Sanity Check examines your proposed value in light of its ability to pay an acquisition loan, a salary to the new owner, and provide a return on investment for the buyer’s cash down payment.

The parameters we use are those commonly expected by third party lenders, including most SBA lenders. They will create a salary expense whether the buyer expects to be paid or not.

Plug in your numbers and see how the price holds up. Hint: If the amount available for debt service isn’t sufficient, try lengthening the term of the loan. It has a big impact!

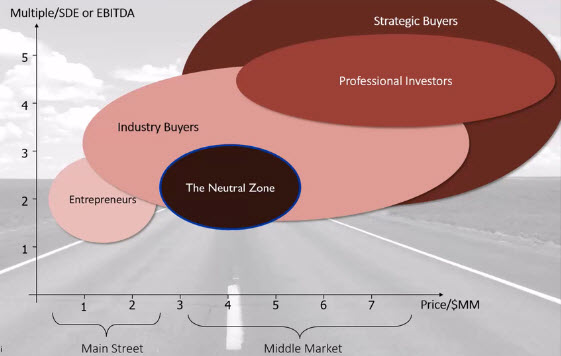

Types of Buyers Watch a two minute video for a realistic look at the demographics of potential buyers of Main Street and Mid-Market companies by multiples of SDE and EBITDA. Click here to view the video.(You will be redirected to the Valuation page.)

Watch a two minute video for a realistic look at the demographics of potential buyers of Main Street and Mid-Market companies by multiples of SDE and EBITDA. Click here to view the video.(You will be redirected to the Valuation page.)

The ExitMap® Assessment©

The First Step to Understanding the Complexities of Preparing a Company for Transition

The ExitMap® Assessment questionnaire consists of 22 questions and produces a high quality 12-page summary report which will be emailed to you. The report ranks the overall preparedness of a company for transition and provides a breakdown of the four major categories of readiness; Finance, Planning, Profit/Revenue and Operations. If you are just starting to think about exit planning or if you just want to know where you and your company stand, this is your first step.