Retirement can be an exciting milestone. It’s also a major lifestyle change. Oftentimes, your daily workday tasks (professionally or if you run your own business) will likely no longer exist.

Retirement can be an exciting milestone. It’s also a major lifestyle change. Oftentimes, your daily workday tasks (professionally or if you run your own business) will likely no longer exist.

Transitioning into retirement for some is an easy process. Perhaps their profession is not their absolute passion, and they always had other pursuits and hobbies they are ready to explore once exiting from their day job. But for others, their profession or business is their passion. They put all their time and energy into it and are dedicated to their profession for many years. Now suddenly, retirement is on the horizon and work is coming to an end. Alternatively, some people have it in their blood to consistently be achieving something, striving to make an impact and difference.

Whichever the case for you, a meaningful life with purpose is a healthy human condition for life fulfillment and longevity. This perspective has been around for generations. Teddy Roosevelt wrote about it in his book, “The Strenuous Life,” written in 1899. To reference his perspective, here is a quote addressing how to live a fulfilling life:

“I wish to preach, not the doctrine of ignoble ease, but the doctrine of the strenuous life, the life of toil and effort, labor and strife; to preach that highest form of success which comes, not to the man who desires mere easy peace, but to the man who does not shrink from danger, from hardship, or bitter toil, and who out of these wins the splendid ultimate triumph. A life of slothful ease, a life of that peace which springs merely from lack either of desire or of power to strive after great things, is as little worthy of a nation as an individual.” – Theodore Roosevelt

Since we’re quoting Teddy Roosevelt about living a fulfilling life, here’s another excerpt from one of his writings titled “Into the Arena”:

“It is not the critic who counts; not the man who points out how the strong man stumbles, or where the doer of deeds could have done them better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does strive to do the deeds; who knows great enthusiasms, the great devotions; who spends himself in a worthy cause; who at the best knows, in the end, the triumph of high achievement, and who at the worst, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who neither know victory nor defeat.”

The reason I bring these quotes into this discussion of retirement is that it’s important to remember just because your time spent working up to this point is coming to an end, doesn’t mean you stop laboring or that you don’t need to put effort into new endeavors or into making a difference.

What Are You Going to Do in Retirement?

I was at a gathering recently and in a conversation with two close friends of mine were discussing retirement, and one said to the other, “It’s not whether you can retire, it’s ‘what are you going to do when you retire?’”. He’s right, in my opinion.

The book, “The Magic of Believing,” written by Claude M. Bristol in 1948, wrote of a man he knew: “One man I know who has many achievements to his credit, and who has passed the seventy mark, declared that most people fall by the wayside because they never start anything.

I make it a plan and have for years, to start something new – that is, new for me – at least once a week. It may be only the making of some simple gadget for use in the kitchen, an entirely new sales plan, or reading an unfamiliar book. I find in following this plan not only keeps my body and mind active but also puts to use a lot of imaginative qualities that otherwise might fall asleep and atrophy. This idea of a man retiring when he’s sixty is (in my option) a great mistake.

As soon as a man retires and quits being active mentally and physically, he’s on the way to his grave in short order. You have seen what happens to fire horses when they are retired. You know what happens to your automobile when you leave it outside unused and neglected: it starts to rust and is soon headed for the junkshop. Humans are the same: they deteriorate out or wither and die when they go on the shelf.”

We Need Purpose in Retirement

I have deliberately referenced writings published many, many years ago to point out that this dilemma is as old as time; the human struggle hasn’t changed. We all still need deep purpose in our lives and the ability to make a difference for ourselves and for others to have a fulfilling life. In the practice of helping business owners exit their business successfully, I have heard stories of owners when facing the day of finalizing the sale of their company, don’t show up for the signing. Why? Because all their self-identity and their purpose are in the company they started, grew, and made a great success. To them, parting from it represents an end to all of that and a loss of a sense of control. But exiting doesn’t have to be viewed as an end. But does take careful thought, reflection, consideration, planning, and time to develop a new purpose and consistent passions. For some this is simple, but for others, takes time and consideration. However, it’s a critical area to address. A person who says that finally I’ll have time to play golf will likely find that passion dissipates after a few months and begin to ask, “now what?”

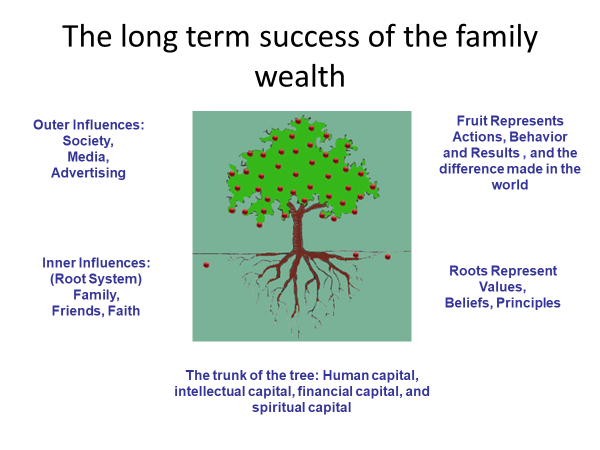

Over the years, our firm has developed a client conversation exercise called “Purposeful Conversation.” Originally, it was developed from our practice of “family legacy development,” We developed our P.C. exercise as a systematized approach to have a deep discussion with a client on “what matters most” to them.

The exercise is broken into three sections: Concerns and Priorities, Commitments and Causes, and Pursuit of Happiness/Life Fulfillment. Each of these areas has nine to twelve potential subjects that a client can consider. We help determine, with the client, the subjects that are relevant and have a deep discussion about importance. This can help them visualize their future, determine their life’s passions during retirement, and help determine what matters most in life. We discuss what makes them happy, what will help them continue to grow, and what brings fulfillment and create a plan now to allow them to focus on and pursue what they desire later.

We also developed a customized workbook to help identify their individual and family values and tie it all into their changing lifestyle.

Pursure Passion in Retirement

Pursuing interests and passions can come in many forms and combinations. Once I took a Lyft from a downtown Denver hotel to the Denver Airport. The driver said that he had started a few tech companies in the past, sold them, and is now driving to meet and learn from other people. I also learned that he decided to learn all he could to master Neuro-Linguistics. This is the study of how verbal and non-verbal language is represented in the brain: that is, how and where our brains store our knowledge of the language that we speak, understand, read, and write. And what happens to our brains as we acquire that knowledge, and how we use it in our everyday lives. I describe it in detail because it’s quite involved! Nevertheless, this gentleman strived to master it and then apply it to his sales training and sales consulting. He told me he was, being hired by companies to facilitate training courses for their sales forces. Wow! Talk about pursuing something else with a passion. I am now connected with him on LinkedIn and learning from him.

You can make a new life in retirement, include whatever you desire, and in a way that brings you maximum fulfillment and meaning. Do whatever “floats your boat,” so to speak.

If you are approaching the runway to land into your retirement years, or the period of your life that transitions you from your profession to your passion, make sure to take time and plan for it. It will be well worth the effort.

I hope you find this article useful. If you have any questions on this subject, feel free to contact me at szeller@zellerkern.com.

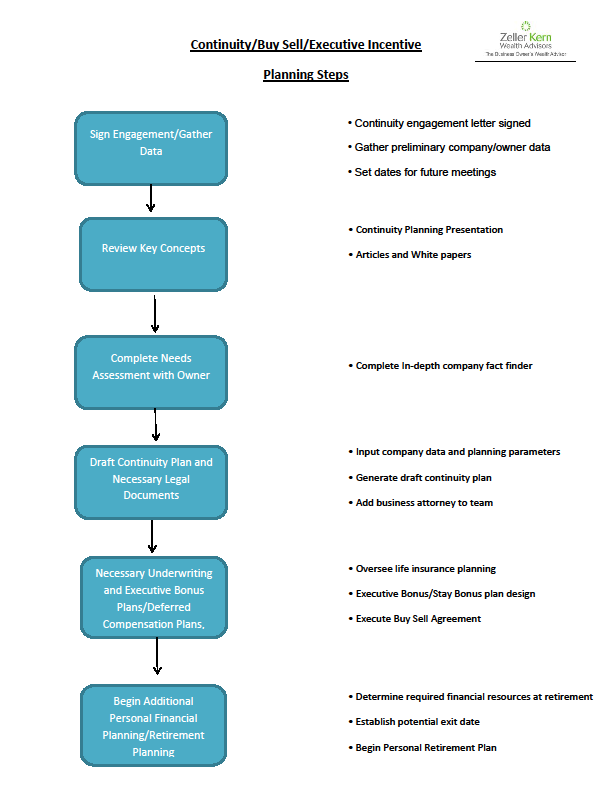

Steven Zeller is a Certified Business Exit Planner, Certified Financial Planner, Accredited Investment Fiduciary, and Co-Founder and President of Zeller Kern Wealth Advisors. He advises business owners with developing exit plans, increasing business value, employee retention, executive bonus plans, etc. He can be reached at szeller@zellerkern.com