Wealth within a family can be a double-edged sword. It can serve as an incredible resource to benefit its family members, but it can also be destructive and divisive. Destructive in the sense that if not properly tended to and respected, wealth can destroy the purpose and outcomes of individual family members, and divisive in the sense that it can damage the bond between family members and cause a splintering of the family.

Wealth and the handling of wealth is a topic that has been discussed or written about throughout the ages, as it is mentioned in both the Old Testament and the Gospels within in the parables of Jesus. Yet often, families don’t properly plan, develop, and practice the preservation and utilization of their wealth in a way that produces favorable outcomes and continues over the generations. The reality that families face is that just because they have addressed the accumulated tangible assets with a planned strategy and structure to transfer those assets, it does not assure that those assets will last and more importantly, promote the growth and well-being of the individual family members, and promote family unity.

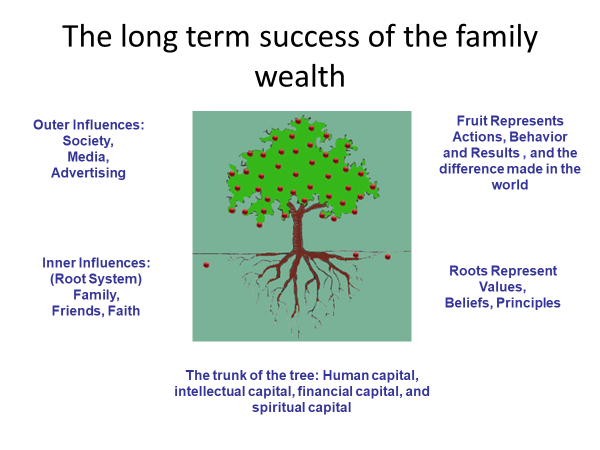

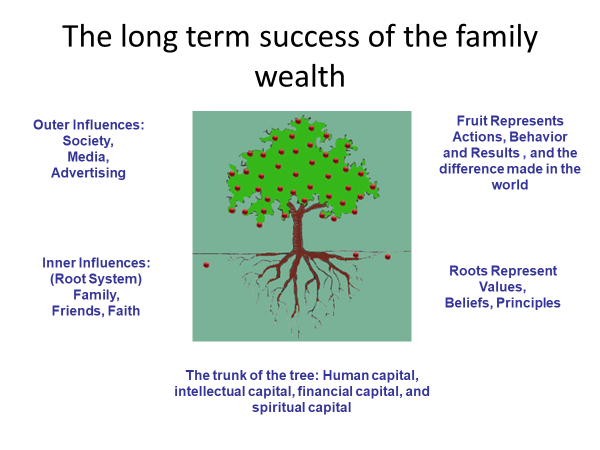

So how does a family address this topic? A good place to start is to change the way wealth is viewed and is approached. First, family wealth is capital, which equals potential (Family Wealth = Capital = Potential). That potential can have a positive effect or have a negative effect. Secondly, family wealth comes in multiple forms – Financial capital, human capital, intellectual capital, and spiritual capital. Wealth in a family means more than just money, assets and material resources, it includes all of the other things such as family heritage, reputation, knowledge, education, passions, purpose, relationships, achievements, personal growth, and values. In fact, the other forms of wealth that I just mentioned are arguably more important to preserve and grow than the tangible form of wealth, because without nurturing and expanding the intangible forms of wealth, the tangible wealth is not likely to survive and breaking family harmony as a consequence. The emotional bonds, unity and harmony of the family members are some of the more powerful components that are critical for preserving family wealth long-term.

Within family unity and harmony lies the development of trust, respect, and communication. These components should be developed and strengthened before financial capital is transferred and deployed. We will discuss that later.

Discussing the Four Forms of Wealth

The forms of family wealth that I mentioned are somewhat subjective but are important to realize and work to develop, grow and protect. Strengthening all 4 forms of family wealth promotes purpose, personal growth, happiness, and well-being. Furthermore, the legacy of this wealth involves every family member and spans over several generations.

Financial Capital – Financial capital consists of the tangibles – Investments, savings, bank accounts, real estate, businesses, precious metals, collectibles etc. – The movable and immovable assets that the family owns. Financial capital can provide a powerful tool with which to promote the growth of the family’s human, intellectual, and spiritual capital.

Human Capital – Human Capital is the most important capital. It is the members of the family and their physical and emotional well-being and self-sufficiency. It’s their ability to pursue happiness, having a higher purpose than themselves, their ability to make a positive impact on their community, and the centeredness of maintaining a strong family. Not only is it vitally important to focus on the strength and growth of this capital long-term, the family needs to work, communicate, and cooperate with each other as a team to help assure that everyone is flourishing to the best of their ability, and work towards common goals.

Intellectual Capital – The strength of a family rests on what it knows. The intellectual capital is the knowledge life experiences and wisdom of each of the family members. gaining knowledge, applying knowledge, and other skill sets to preserve the wealth, and apply it in ways that is conducive for the family and well-being of family members. It is also the competencies of each of the family members. Building a strong foundation of intellectual capital will help drive individual purpose, skills, and the applicable knowledge to preserve and respect the financial capital.

Spiritual Capital – As sad as it is, this subject has become controversial within our society as it becomes more secularized. But the spiritual capital ties in with the happiness, well-being and purpose of each family member, in that if they have a strong spiritual foundation, they have a higher power to live for, go to, and from a meaningful perspective, make a positive difference in the world for the sake and love for mankind through God.

The Importance of Family Harmony

Family unity and harmony are vital for the survival of family wealth. The proactive building of trust and communication needs to begin early on as a family. Why? Because it doesn’t happen overnight and requires working as a team and developing the family bonds that are trusting, compassionate, and cohesive. According to some studies, 70% of estate transitions fail and to which the wealth vanishes. Within the 70% failure rate, 60% of that failure rate was due to a breakdown of trust and communication; 25% was due to the failure to prepare heirs; 10% was due to not having a family mission statement; 5% was deemed to be for other reasons.

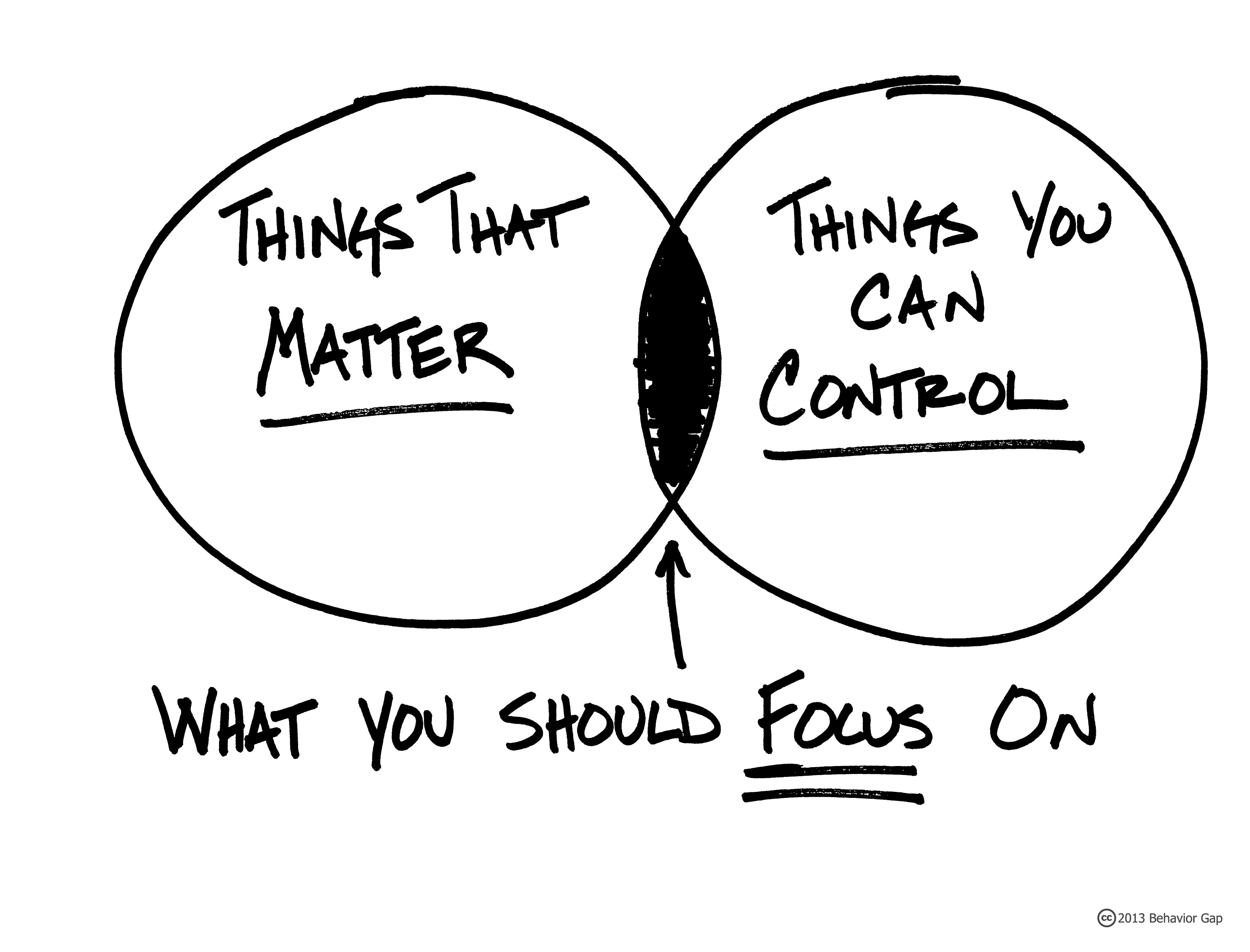

Because of the high failure rate, due to the breakdown of trust and communication, stresses the importance of the family focusing on it and making a consistent effort to strengthen it. Hence, proactively preparing family members involves resolving the breakdowns in communication and trust. It also requires them to work together to establish a family vision and mission statement, aligning those statements with the financial capital, identifying family values, develop roles for each family member, developing performance and quality standards, and work towards family governance involving the whole family.

There is a process that a family can go through starting with the wealth accumulators, or the first generation of wealth. This journey consists of several tools including a family retreat that involves the first generation or the parents that accumulated the wealth. Later, the other generations are brought into the fold with the beginning of family meetings. From there, the building of communication, trust, common causes, the establishment of values, the fine-tuning of the vision and mission statement, etc. are pursued. When this is thoroughly completed, the family can then work towards establishing roles for each individual, develop leadership skills, and develop family governance.

Ultimately, this is the creation of a family legacy, and as I mentioned in the title of this article, it is a multi-generational process and effort. It also is likely that the family will need professionals to help them through the process, which our firm can provide.

Steven Zeller is a Certified Business Exit Planner, Certified Financial Planner, Accredited Investment Fiduciary, and Co-Founder and President of Zeller Kern Wealth Advisors. He advises business owners with developing exit plans, increasing business value, employee retention, executive bonus plans, etc. He can be reached at szeller@zellerkern.com or complete an Exit Readiness Assessment for yourself now.

Even those who have professional appraisals of their business may not understand that the purpose for getting your valuation may skew the results. Valuations that are done for estate planning or internal transfers of equity often have little resemblance to a company’s fair market value.

Even those who have professional appraisals of their business may not understand that the purpose for getting your valuation may skew the results. Valuations that are done for estate planning or internal transfers of equity often have little resemblance to a company’s fair market value. The most commonly stated goals of an exit plan for a business owner are to exit their business on their terms, to receive the highest possible value (or their desired value), and to do so in the most tax efficient manner. It takes time to implement the process to accommodate those objectives. When a business owner rushes to sell their business many things can be overlooked including how to set up the exiting transaction in a way that minimizes taxation.

The most commonly stated goals of an exit plan for a business owner are to exit their business on their terms, to receive the highest possible value (or their desired value), and to do so in the most tax efficient manner. It takes time to implement the process to accommodate those objectives. When a business owner rushes to sell their business many things can be overlooked including how to set up the exiting transaction in a way that minimizes taxation.