Your ExitMap Blog gathers contributions from top exit planning professionals across the country that are indexed into four categories. They include select strategies for planning your exit, ideas for building your company’s value, transfer options you can choose from, or preparing to enjoy your post-exit lifestyle. This page shows the most recent posts from Your ExitMap Blog. If you are seeking a qualified exit planning professional, you can view a map of specialists here.

All articles are copyrighted by the authors, and reprinted here with permission. Each author’s contact information is available via a link at the end of the article.

Most Recent Your ExitMap Blog Articles

Most Recent Blog Articles

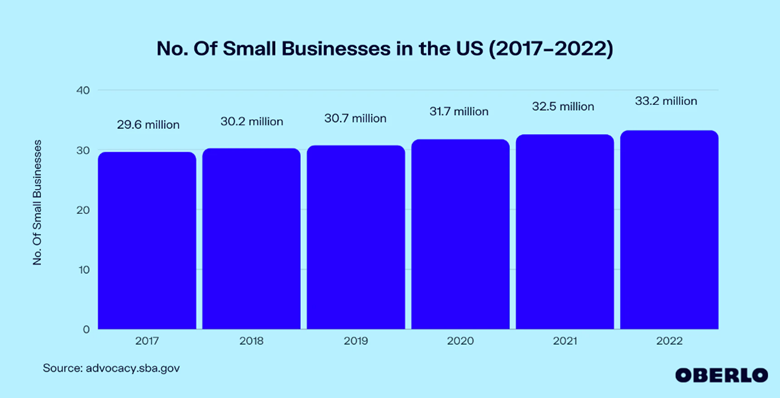

How to Add Millions to The Value of Your Business - Using EBITDA Adjustments As a 5-time entrepreneur who has helped several businesses increase their value, I know what it takes to run a successful business. If you’re trying to figure out what your business might be worth, it’s helpful to consider what acquirers are paying for companies like yours these days. According to Oberlo, the number of small businesses increased from 32.5 million in 2021 to 33.2 million in 2022. This trend shows no signs of slowing down as more and more people are taking their first steps into becoming an entrepreneur. In addition to new businesses, many boomer business owners will be heading into retirement within the ... Read more As a 5-time entrepreneur who has helped several businesses increase their value, I know what it takes to run a successful business. If you’re trying to figure out what your business might be worth, it’s helpful to consider what acquirers are paying for companies like yours these days. According to Oberlo, the number of small businesses increased from 32.5 million in 2021 to 33.2 million in 2022. This trend shows no signs of slowing down as more and more people are taking their first steps into becoming an entrepreneur. In addition to new businesses, many boomer business owners will be heading into retirement within the ... Read more Stakeholders in Exit Planning When preparing for the transfer of a business, there are many stakeholders who can impact your plan. Some have direct authority or decision-making capability over the transaction, but others may have substantial influence. In general, it’s best to presume that anyone who has a relationship with the owner or the business will have some impact on his or her decisions. Internal Stakeholders Of primary importance are partners and shareholders. Even when an owner has a voting majority, minority partners may have an official or unofficial veto. “Official” comes in the form of supermajority rights. Unofficial may be in the form of a threat to terminate ... Read more When preparing for the transfer of a business, there are many stakeholders who can impact your plan. Some have direct authority or decision-making capability over the transaction, but others may have substantial influence. In general, it’s best to presume that anyone who has a relationship with the owner or the business will have some impact on his or her decisions. Internal Stakeholders Of primary importance are partners and shareholders. Even when an owner has a voting majority, minority partners may have an official or unofficial veto. “Official” comes in the form of supermajority rights. Unofficial may be in the form of a threat to terminate ... Read more Exploring Business Exit Strategies: Definitions, Examples, and Top Types Every business journey has a beginning and an end. Just as you plan how to start your business, it’s essential to plan how you’ll eventually step back or move on. This is where a business exit strategy comes in. Simply put, it’s a plan that helps business owners decide when and how to sell or close their business in an organized way. But, how do you know it’s time? Read ahead to find out. Understanding Business Exit Strategies: Definition and Importance A business exit strategy is a well-thought-out plan that outlines how an entrepreneur or business owner will sell, dissolve, or transition out of their ... Read more Every business journey has a beginning and an end. Just as you plan how to start your business, it’s essential to plan how you’ll eventually step back or move on. This is where a business exit strategy comes in. Simply put, it’s a plan that helps business owners decide when and how to sell or close their business in an organized way. But, how do you know it’s time? Read ahead to find out. Understanding Business Exit Strategies: Definition and Importance A business exit strategy is a well-thought-out plan that outlines how an entrepreneur or business owner will sell, dissolve, or transition out of their ... Read more How a Business Owner Can Effectively Plan Their Exit Many business owners are finding it difficult to retire or transition out of their business due to a lack of exit planning together with a challenging economic environment. Shrinking cash flow, net income and credit have forced owners into fight-or-flight mode. Several companies have successfully compensated by trying to expand sales and cutting costs. Many small to mid-sized companies, however, have experienced a drop in value, with no end in sight. Owners are also entering the chapter in their life when exiting their business in one way or another is becoming more probable. Unfortunately, the business may not be currently worth what they need it ... Read more Many business owners are finding it difficult to retire or transition out of their business due to a lack of exit planning together with a challenging economic environment. Shrinking cash flow, net income and credit have forced owners into fight-or-flight mode. Several companies have successfully compensated by trying to expand sales and cutting costs. Many small to mid-sized companies, however, have experienced a drop in value, with no end in sight. Owners are also entering the chapter in their life when exiting their business in one way or another is becoming more probable. Unfortunately, the business may not be currently worth what they need it ... Read more What are the Critical Elements in Training My Business Successor? Training your Business Successor is crucial in ensuring a smooth transition of ownership and leadership. The following are critical elements to consider when preparing your Business Successor: Knowledge Transfer: Identify the knowledge and skills necessary to run the business effectively. Document and share critical information, processes, and best practices with your successor. This includes financial management, sales and marketing strategies, operational procedures, customer relationships, vendor management, and industry-specific knowledge. Mentoring and Shadowing: Provide your successor with hands-on experience by allowing them to shadow you and observe your day-to-day activities. Encourage them to ask questions, participate in decision-making, and gradually take on more responsibilities. Act as ... Read more Training your Business Successor is crucial in ensuring a smooth transition of ownership and leadership. The following are critical elements to consider when preparing your Business Successor: Knowledge Transfer: Identify the knowledge and skills necessary to run the business effectively. Document and share critical information, processes, and best practices with your successor. This includes financial management, sales and marketing strategies, operational procedures, customer relationships, vendor management, and industry-specific knowledge. Mentoring and Shadowing: Provide your successor with hands-on experience by allowing them to shadow you and observe your day-to-day activities. Encourage them to ask questions, participate in decision-making, and gradually take on more responsibilities. Act as ... Read more Exit Strategies - The Road Less Traveled The road less traveled is often a misimpression when considering a transition from business ownership. Surveys show that roughly 85% of owners expect their exit to happen via a sale of the business to a third party. A third-party sale is certainly attractive. The idea of monetizing decades of work in one lump-sum payoff seems equitable. Years of sacrificing to “invest in the business” is supposed to generate a return. “He (or she) sold the company” when applied to someone who is clearly enjoying a comfortable lifestyle in retirement acts as an advertisement for the benefits of cashing out. Unfortunately, that isn’t only less frequent ... Read more The road less traveled is often a misimpression when considering a transition from business ownership. Surveys show that roughly 85% of owners expect their exit to happen via a sale of the business to a third party. A third-party sale is certainly attractive. The idea of monetizing decades of work in one lump-sum payoff seems equitable. Years of sacrificing to “invest in the business” is supposed to generate a return. “He (or she) sold the company” when applied to someone who is clearly enjoying a comfortable lifestyle in retirement acts as an advertisement for the benefits of cashing out. Unfortunately, that isn’t only less frequent ... Read more The Build vs. Buy Equation If you’re wondering what your business might be worth to an acquirer, there is a simple calculation you can use. Let’s call it “The Build vs. Buy Equation”. At some point, every acquirer does the maths and calculates how much it would cost to re-create what you’ve built. If an acquirer figures they could buy your business for less than they would spend on both the hard and soft costs of re-deploying their employees to build a competitive product, then they will be inclined to acquire yours. If they think it would be less costly to create it themselves, they are likely to choose to ... Read more If you’re wondering what your business might be worth to an acquirer, there is a simple calculation you can use. Let’s call it “The Build vs. Buy Equation”. At some point, every acquirer does the maths and calculates how much it would cost to re-create what you’ve built. If an acquirer figures they could buy your business for less than they would spend on both the hard and soft costs of re-deploying their employees to build a competitive product, then they will be inclined to acquire yours. If they think it would be less costly to create it themselves, they are likely to choose to ... Read more Is there an AI role in Exit Planning? The media is packed with stories about Artificial Intelligence. According to the stories, because a smart search engine (which is essentially what a Learning Language Model [LLM] is) can pass a Bar exam, it threatens all kinds of white-collar careers. And in case you were wondering, no – I’m not writing this on ChapGPT. That “surprise” trope has been so overdone on every local television station that I hope I never see it again. Also, if you thought this column would be about how to write letters, proposals, and social media posts using AI, you’ll have to look elsewhere. At ExitMap® we launched our ... Read more The media is packed with stories about Artificial Intelligence. According to the stories, because a smart search engine (which is essentially what a Learning Language Model [LLM] is) can pass a Bar exam, it threatens all kinds of white-collar careers. And in case you were wondering, no – I’m not writing this on ChapGPT. That “surprise” trope has been so overdone on every local television station that I hope I never see it again. Also, if you thought this column would be about how to write letters, proposals, and social media posts using AI, you’ll have to look elsewhere. At ExitMap® we launched our ... Read more Exit Strategies for Small Business Owners: A Summary Guide There comes a time for everyone to move on from the business they’ve created– some happier reasons than others. But even if you’re just starting, having an exit strategy for your business will help prime you for success, rather than leaving value on the table when the time comes. This guide will walk you through the signs to sell, the basics of valuation, options for selling your business, and tips on adjusting to life after the sale. Before you are ready to sell, it’s important to walk through this process with an experienced exit planner. This will best prepare you, not just for selling your ... Read more There comes a time for everyone to move on from the business they’ve created– some happier reasons than others. But even if you’re just starting, having an exit strategy for your business will help prime you for success, rather than leaving value on the table when the time comes. This guide will walk you through the signs to sell, the basics of valuation, options for selling your business, and tips on adjusting to life after the sale. Before you are ready to sell, it’s important to walk through this process with an experienced exit planner. This will best prepare you, not just for selling your ... Read more What is a Certified Business Valuation and When Do I Need One? A Certified Business Valuation is a comprehensive assessment conducted by a qualified professional to determine the fair market value of a business. It involves a systematic analysis of various factors such as financial statements, industry trends, market conditions, company assets, intellectual property, customer base, and other relevant aspects to estimate the worth of a business. You may need a Certified Business Valuation in several situations, including: Selling or Buying a Business: When you’re involved in a business sale or acquisition, a valuation helps determine a fair asking price or offer, ensuring both parties understand the business’s value. Obtaining Financing: When seeking a loan or financing ... Read more A Certified Business Valuation is a comprehensive assessment conducted by a qualified professional to determine the fair market value of a business. It involves a systematic analysis of various factors such as financial statements, industry trends, market conditions, company assets, intellectual property, customer base, and other relevant aspects to estimate the worth of a business. You may need a Certified Business Valuation in several situations, including: Selling or Buying a Business: When you’re involved in a business sale or acquisition, a valuation helps determine a fair asking price or offer, ensuring both parties understand the business’s value. Obtaining Financing: When seeking a loan or financing ... Read more |

|

Keystone Content: Are you just beginning your exit planning journey? Here are two short articles from Your ExitMap Blog to help get you started. 3 Inarguable Reasons How prepared are you to Take a FREE 15-minute FIND A QUALIFIED EXIT PLANNER |