As a 5-time entrepreneur who has helped several businesses increase their value, I know what it takes to run a successful business. If you’re trying to figure out what your business might be worth, it’s helpful to consider what acquirers are paying for companies like yours these days.

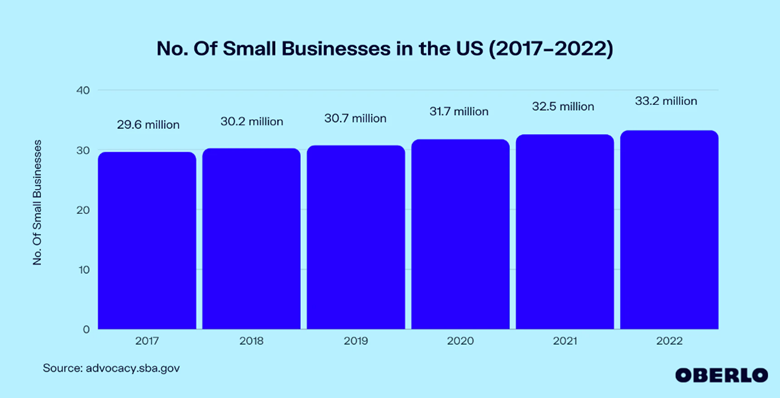

According to Oberlo, the number of small businesses increased from 32.5 million in 2021 to 33.2 million in 2022. This trend shows no signs of slowing down as more and more people are taking their first steps into becoming an entrepreneur.

In addition to new businesses, many boomer business owners will be heading into retirement within the next decade, adding even more competition for the attention of buyers.

With both of these factors in mind, it is normal for more established organizations to wonder if the increase in new competition will have an impact on the value of their business when it comes time to sell.

While this can be intimidating, there is a process a business owner that is looking to retire can take to ensure a profitable exit.

Obsessing Over Your Multiple

If my 25 plus years of experience has taught me anything, it’s that a business trades for a multiple of your pre-tax profit, which is Sellers Discretionary Earnings (SDE) for a small business and Earnings Before Interest Taxes, Depreciation and Amortization (EBITDA) for a slightly larger business.

This multiple can transfix entrepreneurs. Many owners want to know their multiple and how they can increase its value.

After all, if your business has $500,000 in profit, and it trades for four times profit, it’s worth $2 million; if the same business trades for eight times profit, it’s worth $4 million.

Obviously, your multiple will have a profound impact on how much you will realize on the sale of your business, but there is another number worthy of your consideration as well: the number your multiple is multiplying.

How Profitability Is Open to Interpretation

Most entrepreneurs think of profit as an objective measure, calculated by an accountant, but when it comes to the sale of your business, profit is far from objective. Your profit will go through a set of “adjustments” designed to estimate how profitable your business will be under a new owner.

This process of adjusting—and how you defend these adjustments to an acquirer—is where you can dramatically spike your company’s value.

How to Increase Your Companies Value in Time for Retirement with EBITDA Adjustments.

Let’s take a simple example to illustrate. Imagine you run a company with $3 million in revenue and you pay yourself a salary of $200,000 a year. Further, let’s assume you could get a competent manager to run your business as a division of an acquirer for $100,000 per year.

You could safely make the case to an acquirer that under their ownership, your business would generate an extra $100,000 in profit. If they are paying you five times profit for your business, that one adjustment has the potential to earn you an extra $500,000.

You should be able to make a case for several adjustments that will boost your profit and, by extension, the value of your business.

This is more art than science, and you need to be prepared to defend your case for each adjustment. It is important that you make a good case for how profitable your business will be in the hands of an acquirer.

Some of the most common EBITDA adjustments relate to:

Rent (common if you own the building your company operates from and your company is paying higher-than-market rent).

Repairs and maintenance.

Start–up costs.

One-off lawsuits.

Insurance claims.

One-time professional services fees.

Lifestyle expenses.

Owner salaries and bonuses.

Family members wages and benefits.

Non-arms length revenue or expenses.

Revenue or expenses created by redundant assets.

Inventories

Your multiple is important, but the subjective art of adjusting your EBITDA is where a lot of extra money can be made when selling your business.

Joe Gitto, CEPA is an accomplished senior Finance, Sales and Operational Executive, Entrepreneur, Coach, Thought Leader, and Board Member with more than 25 years of success in various industries.