Over the last few weeks, I’ve had a number of conversations with clients about key man insurance. Let me say at the outset that I don’t sell insurance, and have no financial stake in whether any client has coverage or not. The use of such policies, however, may not always fit their intended purpose, especially in smaller companies.

The most common intended purpose of a key man policy is to fund a buy/sell agreement. The benefit payment goes to the company, which in turn uses the proceeds to purchase ownership from the family or estate of the deceased. If it works that way, it’s an excellent planning tool for your family’s security, but there are a number of things that can get in the way.

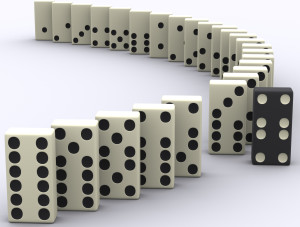

To begin, the company probably needs the money. If they are scrambling to replace you in the business, partners may be reluctant to part with a cash windfall that can keep them going. In most cases, the insurance company’s responsibility ends when payment is made. The buy/sell is a separate agreement, and enforcing it may require legal action by the bereaved family. In the meantime, the cash is being used elsewhere.

Surprisingly, some policies are in place to buy out a sole owner. A company can’t own all of it’s own stock. Someone else has to have at least minimum ownership, since treasury stock (repurchased by the company) has no voting power. If the buy/sell was put in place for former partners, you may want to revisit both the shareholder agreement and the policy.

Finally, there is the small matter of company debt. The absence of the principle credit guarantor (which applies to most majority owners) will trigger repayment clauses. Lenders are in the business of mitigating loan risk, and credit agreements likely give them first call on any available funds. Unless the company remains on a strong footing, with another guarantor who can step into the primary role, the insurance payout might not be available to either the heirs or the business.

Finally, there is the small matter of company debt. The absence of the principle credit guarantor (which applies to most majority owners) will trigger repayment clauses. Lenders are in the business of mitigating loan risk, and credit agreements likely give them first call on any available funds. Unless the company remains on a strong footing, with another guarantor who can step into the primary role, the insurance payout might not be available to either the heirs or the business.

There’s one additional area where the objectives of a key man policy and a buy/sell agreement may not meet. That is in long-term disability. Because most buy/sells lump repurchase terms for death and disability together, many owners forget that the insurance only pays in the first event, and has nothing to do with the second.

There are many approaches to obtaining coverage to secure your family’s financial well-being and/or the sustainability of your business. Although I’m an exit planner, that world of split premiums, whole and universal life, insurance trusts and other, far more arcane structures makes my head spin. All I can advise is if your current broker advertises “auto/home/life” he is not likely the kind of specialist you need. Find someone who is experienced in reviewing shareholder or partnership agreements, and who can tailor a product for your requirements.

Thanks to all the readers who responsed to last week’s survey on energy costs. Just under 69% said either “Falling energy prices are good for my business” or “rising energy prices are bad for my business.” Of course, 14% said the opposite, which just proves my point.