We’ve looked at the coming generation of business buyers, and many things about that picture aren’t pretty. When I present to business owners about the Boomer Bust, this is around the time that someone in the audience says “So, are we just screwed?”

No. There are things you can do to make your business more transferable, and more appealing to those buyers who will be looking for an opportunity.

First, remember that my generalizations about a generation are just that. Both words derive from the Latin root genus, which meant both “birth” and “type.” A historical comment: it’s interesting that one word meant both things, because it was an era when your birth determined your type, or your role in society for life.

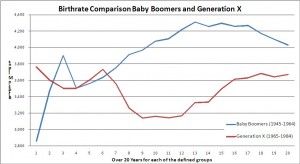

Not every Boomer is a workaholic. I know plenty of slacker Boomers, although none that are successful business owners. I also know plenty of hard-charging X’ers. So the first thing to remember as Boomer business owner is that Generation X buyers for your business aren’t nonexistent. They are just far fewer than the number of sellers because of their numbers, values and choices.

Second, every business problem is better tackled with planning and preparation. Positioning your business for a successful sale is like putting timers on your lights at home. Any experienced burglar will tell you that he can case a house for a few nights to determine whether there are timed lights, but why should he? There are far more houses that don’t have any precautions at all. Most privately held businesses aren’t planning for transition, and won’t be ready when the time comes.

A third reason not to be depressed is remembering who you are. If you recognize yourself in our profile of the hard-working, driven Boomer business owner we’ve presented here, then your competitive nature should kick in as you think about being one of the winners in the transition.

After all, selling your company is probably the most significant financial event of your lifetime. Why wouldn’t you approach it with all the energy and problem-solving ability that you possess?

Any successful transition of your business is a sale, whether it is to a third party, to employees or to family. We will use sale as a generic term synonymous with succession, transition. merger or acquisition just to keep things simpler. When I am speaking about a specific approach, I will differentiate between an internal sale (to employees or family) and an external sale (to a third party).

I’m also focusing on the transfer of a business from an individual, or a few partners, to another individual or partner group. Many small business owners approach me looking for a third party sale to a “strategic buyer.” All they know is that they’ve heard a strategic buyer pays far higher multiples than other buyers, so that’s the kind of buyer they want.

Very few companies selling for less than $10,000,000 are sold to strategic buyers. It is more frequent in technology and in some distribution channels than in other industries, but it isn’t common at all. If you are a typical small business providing services on a local basis, a franchisee, a retailer, or a professional firm; there is little likelihood that you offer the kind of strategic differentiation required to attract a large (and wealthy) corporation to your door.

Understanding your prospective buyer is a key part of the selling process, but it isn’t the only part. before we discuss how to position for the next generation(s) of buyers, we have to step aside to talk about where you begin.

The Starting Point

Preparing for a successful sale to a typical small business buyer begins with an honest assessment of where you are today. What is your company really worth?

Most business owners have a very subjective approach to valuing their business. They talk to colleagues at trade shows about rumored prices for sales in their industry. They ask other business owners in their local area about the sale prices of unrelated companies. They read stories in the news about publicly traded acquisitions. Then they pick the number they like the best. “After all,” they say, “my business is as good as anyone else’s.”

prices for sales in their industry. They ask other business owners in their local area about the sale prices of unrelated companies. They read stories in the news about publicly traded acquisitions. Then they pick the number they like the best. “After all,” they say, “my business is as good as anyone else’s.”

I see too many cases where owners become emotionally committed to that number, to the point where they are highly offended by any other. They tell their personal financial planner to use the number in their retirement planning. They put the number on their personal financial statements to the bank. After a while, that number becomes fact, whether it originally had any basis or not.

Your planner or your banker isn’t qualified to verify the value you place on your business. For many owners whose net worth is 50% or more dependent on their business asset, picking a number based on hearsay or second-hand information is tantamount to insanity. It is your biggest asset, don’t you want to know what it worth?

There are a number of valuation specialists who can appraise your company. Any qualified professional will look at comparative sales, the market, your industry and the current cost of financing.For most small businesses, a reasonable appraisal can be purchased for a few thousand dollars. (A side note: “free” appraisals or those generated in one-day seminars are often worth what you paid for them.) Once you have it, you can use the logic and multiples to track your approximate value for at least several years.

The Target

Once you know what your business is worth, targeting becomes much simpler. You take your net worth today (without your business), determine what you will need at retirement, and the sale price of your company has to make up the difference. A Certified Financial Planner has the ability to help you project your retirement needs, as well as the software to calculate tax implications and inflation.

With the company’s real present value documented, and a target amount based on realities of the market, you can set a date for your exit.

Setting a date is much, much more than just a theoretical exercise. Every plan must start with a goal, and your goal has to be both time and amount sensitive. “I’ll keep working until my business is worth $5,000,000.” isn’t a plan. “I’ll quit when I am 65 years old, and just hope that I have enough to live on.” isn’t a plan.

Setting a date is much, much more than just a theoretical exercise. Every plan must start with a goal, and your goal has to be both time and amount sensitive. “I’ll keep working until my business is worth $5,000,000.” isn’t a plan. “I’ll quit when I am 65 years old, and just hope that I have enough to live on.” isn’t a plan.

Setting your exit date doesn’t mean you have to stop working. It doesn’t even mean you have to leave your business. It’s just the target for when you can leave your business. Once you are there, the actual timing is up to you.

If you have a plan, you can start positioning for the sale. That’s where understanding your buyers’ market begins.

(This is the eighth installment in a series about “Beating the Boomer Bust.” Previous installments are The Approaching Tidal Wave, The Pig in the Python, The Brass Ring, Work-Life Balance, Outsourcing America , The X Factor and The Gen X Business Buyer.)

If you are as acutely aware of the impact of Boomers on the American economy as I am, you begin to see it in a lot of places. I attended a luncheon with an official of the Federal Reserve a few weeks ago, and a question was raised about the recovery of residential housing. He pointed out that the introduction of 30-year mortgages with only 20% down transformed the US into a country of homeowners.

If you are as acutely aware of the impact of Boomers on the American economy as I am, you begin to see it in a lot of places. I attended a luncheon with an official of the Federal Reserve a few weeks ago, and a question was raised about the recovery of residential housing. He pointed out that the introduction of 30-year mortgages with only 20% down transformed the US into a country of homeowners.