This is a cautionary tale for business owners—one that’s “based on a true story.” The facts are real, although the exact sequence of events might raise questions if the IRS were to take a closer look.

A small business owner received a $1,000,000 offer to sell his company. He had already been thinking about retirement, and the chance to cash out felt like a perfect opportunity. His original plan had been to sell the business to a long-time employee through a promissory note, but that changed when the cash offer came along.

The business’s profits had always been modest, and the employee couldn’t match the offer. But the owner felt deep appreciation for the employee’s loyalty and past contributions. The employee already owned 10% of the stock, and the owner decided to reward him further by gifting an additional 10% just before the sale.

When the deal closed a few weeks later, they divided the proceeds: the owner received $800,000, and the employee got $200,000.

Here’s where things began to unravel.

The company’s tax preparer was a long-time friend of the owner—also his bookkeeper—who had served him faithfully for over 30 years. Their arrangement worked well for general business needs, and the owner saved money on fees. But the employee used a different advisor. And when tax season rolled around, that advisor raised some critical issues.

Let’s break it down.

The Letter of Intent was signed in January. The additional 10% stock was granted in February. The transaction closed in March. The valuation had been set by the sale offer, but little formal documentation existed for the transfer. The employee’s advisor flagged that the gifted stock constituted a $100,000 bonus—meaning it was taxed as ordinary income. At a 25% tax bracket, that single item triggered a $25,000 IRS bill.

Next came the issue of the company’s structure-

For years, the tax preparer had advised switching to an S Corporation, but the owner never followed through—it seemed like too much hassle. So the company remained a C Corporation and was subject to 21% corporate tax before distributions.

That meant the employee’s $200,000 had to be recalculated. His share was now about $158,000 after corporate taxes.

Of that amount, the original 10% was eligible for long-term capital gains treatment (20% rate), but the recently gifted 10% was double taxed: as short-term capital gain (at his 25% rate) and hit with a 20% parachute payment excise tax because of its proximity to the sale.

He paid nearly $55,000 in taxes just on that second 10%. And the hits kept coming.

With total compensation now over $200,000, the employee’s payout was subject to the 3.8% Net Investment Income tax (the “Obamacare” surcharge). And he still owed that initial $25,000 from the stock bonus.

When all the math was finished, his $200,000 “windfall” ended up being worth only $70,746.

That’s an effective tax rate of nearly 65%.

And the owner? He was double taxed, too. His “cut-rate” accounting services and the decision to avoid S Corporation status ended up costing far more than they saved.

Could it have gone differently? Absolutely.

For a relatively small investment in expert guidance, they might have restructured the transaction. For instance, compensating the employee with a cash bonus instead of stock would have made the payment deductible to the company, taxed only once as ordinary income to the employee.

But none of that was considered—because there was no experienced advisor at the table.

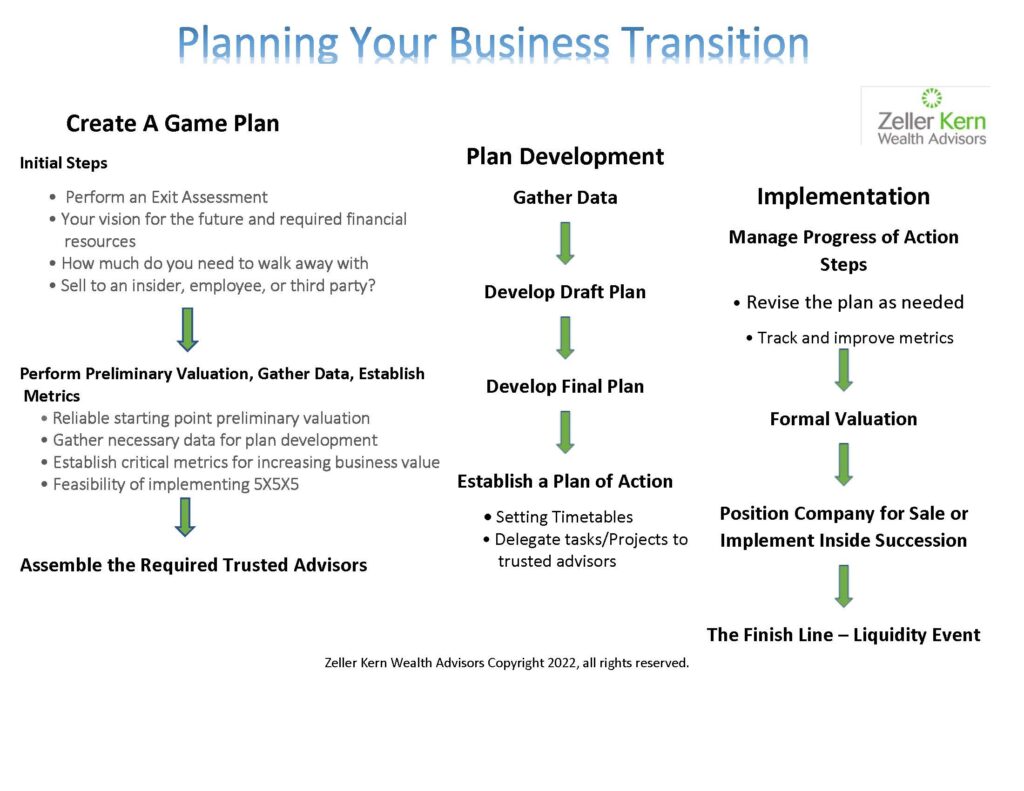

If you’re considering selling your business, don’t go it alone.

Exit planning isn’t just about getting a good offer—it’s about protecting your value and avoiding costly mistakes. Engage with a seasoned advisor who understands the tax, legal, and strategic layers of a business transition.

The cost of advice is small compared to what it could save you.

-Special thanks to Steven A. Bankler, CPA, for his help with this article.

John F. Dini develops transition and succession strategies that allow business owners to exit their companies on their own schedule, with the proceeds they seek and complete control over the process. He takes a coaching approach to client engagements, focusing on helping owners of companies with $1M to $250M in revenue achieve both their desired lifestyles and legacies.